Article content

Updated Study Demonstrates Longer Mine Life, Lower Capital Costs, and Stronger Economics

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

TORONTO, Sept. 17, 2025 (GLOBE NEWSWIRE) — Lithium Ionic Corp. (TSXV: LTH; OTCQB: LTHCF; FSE: H3N) (“Lithium Ionic” or the “Company”) is pleased to announce results from the updated Feasibility Study (“FS” or the “Study”) for its 100%-owned Bandeira Lithium Project (“Bandeira” or the “Project”), located in Minas Gerais, Brazil, conducted in partnership with R-TEK International (“RTEK”; see press release dated April 2, 2025). This updated FS incorporates a larger mineral resource and reserve and optimized mine and plant design, positioning Bandeira to be one of the lowest-cost hard rock spodumene projects globally.

Article content

Article content

Article content

Highlights of the Updated Feasibility Study:

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Project Snapshot

Article content

| • | Post Tax IRR | 61% |

| • | Post Tax NPV8% | US$1.45B |

| • | CAPEX | US$191M |

| • | OPEX | US$378/t spodumene concentrate |

| • | Mine Life | 18.5 years |

| • | Pay Back | 2.2 years |

Article content

Article content

Compared to the May 2024 Feasibility Study:

Article content

Stronger Economics

Article content

- Post-tax NPV8% improved to US$1.45 billion, compared to US$1.31 billion in the May 2024 FS (the “Prior Study”) despite applying more conservative commodity price assumptions based on Fastmarkets’ long-term forecast.

- Post-tax IRR increased to 61%, up from 40%.

- Payback period reduced to 2.2 years, compared to 3.4 years previously.

Article content

Tangible CAPEX and Operating Cost Reductions

Article content

- Site operating cost of US$378/t spodumene concentrate 5.2% (“SC5.2”).

- Initial CAPEX reduced by ~28% to US$191 million (including contingency), versus US$266 million in the Prior Study, through:

- Simplified surface facilities and proven modular plant design supported by RTEK.

- Optimized mine scheduling to generate earlier cash flow.

- Streamlined fleet and equipment selection leveraging local supply chains.

Article content

Longer Mine Life

Article content

Article content

- Mine life of 18.5 years, up from 14 years in the Prior Study, supported by a 6 million tonne increase in proven and probable reserves from the 2024 drill campaign.

- Average annual life-of-mine (“LOM”) rate of production of 177,000 tpa of spodumene concentrate.

Article content

Optimized Flowsheet

Article content

- Plant flowsheet incorporates proven technology supported by RTEK’s operational track record at multiple hard rock spodumene deposits.

- More conservative metallurgical recovery of 65% aligned with hard rock dense media separation (DMS) peer producers.

Article content

Responsible Environmental Design

Article content

- Bandeira’s mine plan is designed to minimize land disturbance and water consumption, supported by a long-term underground mining strategy that reduces dust and noise.

- Optimized processing flowsheet and dry-stacked tailings are expected to reduce overall water consumption and facilitate faster site rehabilitation.

- Dry stacking ensures enhanced safety and lower environmental risk versus conventional wet tailings storage.

Article content

Blake Hylands, P.Geo., Chief Executive Officer of Lithium Ionic, commented, “This updated Feasibility Study reflects the incredible effort of our team and the expertise of RTEK, who together have optimized every aspect of Bandeira. What was already a robust project is now even stronger – delivering a longer mine life, lower capital requirements and significantly improved project economics. These results reinforce Bandeira’s position as one of the most competitive hard-rock lithium projects globally, situated in Brazil’s Lithium Valley, a region recognized for producing some of the world’s highest-quality spodumene concentrate. As demand for lithium continues to grow to support global supply chains and the energy transition, Bandeira is exceptionally well positioned to play a key role as a low-cost, reliable supplier.”

Advertisement 1

Advertisement 2

Article content

Table 1. Bandeira FS – Summary of Key Results and Assumptions Compared to May 2024 Feasibility Study (all figures in USD unless otherwise stated)

Article content

| Feasibility Studies | May 2024 | Sept. 2025 |

| Project Economics | ||

| Post – Tax NPV8 | $1.31 B | $1.45 B |

| Post – Tax IRR | 40% | 61% |

| Pre – Tax NPV8 | $1.57 B | 1.72 B |

| Pre – Tax IRR | 44% | 68% |

| Annual Gross Revenue – LOM Average | $417 M | $343 M |

| Average Annual After-Tax Free Cash Flow (after repayment of initial capital) | $286 M | $208 M |

| Payback | 41 months | 26 months |

| Production Profile | ||

| Total Project Life (LOM) | 14 years | 18.5 years |

| Total LOM production (ore mined) | 17.2 Mt | 23.2 Mt |

| Total concentrate production (LOM) | 2,493 kt SC5.5 (338 kt LCE) | 3,198 kt SC5.2 (411 kt LCE) |

| Nominal Plant Capacity | 1.30 Mtpa | 1.50 Mtpa |

| Average plant throughput | 1.23 Mtpa | 1.29 Mtpa |

| Run-of-Mine grade, Li2O (mine diluted) | 1.16% | 1.10% |

| Average Annual Production of Spodumene Concentrate | 178 ktpa (SC5.5) | 177 ktpa (SC5.2) |

| Metallurgical Recovery | 68.9% | 65.3% |

| CAPEX & OPEX | ||

| Initial Capital Costs | $266M | $191M |

| Sustaining CAPEX | $81M | $100M |

| Site Operating costs (5.2% Basis) | $420/t | $378/t |

Article content

Article content

Bandeira Updated Feasibility Study Results

Article content

Article content

The updated Feasibility Study builds on the 2024 Prior Study, incorporating an expanded mineral resource estimate while lowering both capital and operating costs. The design was developed with the support of experienced consulting groups including RTEK, Promon, RETA, and GE21.

Article content

The 30% increase in Measured & Indicated resources at Bandeira (see May 6, 2025, press release) has increased Proven and Probable reserves by 6.0Mt (please see below for further details), extending the mine life by 4.5 years. The updated mine plan presents a lower-risk production scenario, enabling faster time to revenue and a shorter project payback period.

Article content

With RTEK’s expertise, the processing plant and surface facilities were streamlined using industry-standard equipment and proven prefabricated modular process plant segments, reducing fabrication and installation costs. Drawing on experience from two plants manufactured in 2024 and many others throughout recent years, RTEK brings proven designs, implementation and commissioning expertise that minimizes startup risk and ensures predictable implementation and operating costs.

Article content

Article content

The FS applies more conservative spodumene price forecasts provided by Fastmarkets and fully accounts for updated royalties, taxes, and transportation charges, yet still delivers materially improved economics, highlighted by a higher NPV and significantly stronger IRR compared to the 2024 Prior Study.

Article content

Project Location and Infrastructure

Article content

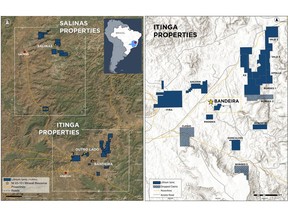

The Bandeira property covers 157 hectares, representing only approximately 1% of the Company’s large 14,668-hectare land package in the northern region of Minas Gerais State, Brazil, within the renowned “Lithium Valley” (see Figure 1). This area is recognized for its significant concentration of lithium-bearing pegmatites, making it one of the most promising lithium-producing regions globally. The Project benefits from excellent local infrastructure, which is critical for the efficient development and operation of the future mining activities.

Article content

The Bandeira site is well-connected via major highways, facilitating the transport of materials and personnel. The project site is approximately 570 kilometers from the port of Ilhéus in Bahia, which serves as a key logistical point for exporting lithium concentrate to international markets, including Shanghai, China. The proximity to Araçuaí provides access to essential services and amenities, enhancing operational efficiency.

Article content

A key infrastructure component for the Bandeira Project was secured in October 2023 through an agreement with Cemig Distribuição S.A. (“Cemig”). This agreement facilitates the construction and electrification of essential power infrastructure, including three kilometers of new transmission lines and a new substation adjacent to the future Bandeira mine and will ensure that the Project will be powered by low-cost, renewable hydroelectric power, aligning with the Company’s commitment to operating sustainably.

Article content

Article content

Figure 1. Lithium Ionic Claims Map Showing Bandeira Project Location

Article content

Article content

Mining Operations

Article content

The updated Bandeira mine plan is centered on sub-level stope mining to deliver consistent, high-grade material to the processing plant. A key advantage of this underground approach is the reduced surface footprint and minimized environmental impact, achieved by limiting waste movement. The optimized mine sequence prioritizes near-surface ore, allowing material to feed the plant earlier in the development cycle.

Article content

Article content

The operating model begins with engaging a proven mining contractor for the initial development phase, transitioning to an owner-operated team to minimize life-of-mine operating costs.

Article content

Article content

Figure 2. ROM to Plant Feed and Li2O grade %

Article content

Article content

Article content

Figure 3. Annual Production of Spodumene Concentrate grading 5.2% Li2O

Article content

Article content

Mineral Processing

Article content

The process plant flowsheet follows the same proven design principles as peer operations adjacent to Bandeira, ensuring reliability and consistency. The design remains simple, incorporating crushing, sorting, screening, dense media separation (DMS), and dewatering. RTEK’s modular design approach uses industry-standard equipment pre-assembled on structural steel at an off-site facility, reducing on-site assembly time and costs. In addition, layout optimizations lower capital intensity by minimizing earthworks and civil construction requirements for plant assembly.

Article content

Article content

Article content

Figure 4: Bandeira Process Flow Diagram

Article content

Article content

Article content

Figure 5: Bandeira 3D View of Mineral Processing Plant

Article content

Article content

Capital Costs

Article content

Initial capital costs for the Bandeira Project are estimated at US$191 million including contingency, reduced by approximately 28% from the Prior Study which had a CAPEX of $266 million. The sustaining capital over the 18.5-year mine life is projected at $100 million. A breakdown of the capital costs is presented in Table 2.

Article content

Table 2. Project Capital Costs (CAPEX) Breakdown

Article content

| Initial CAPEX | $191M |

| Mine | $59.2M |

| Mining Equipment | $18.5M |

| Equipment Purchase | $27.2M |

| Equipment Financing | ($9.6M) |

| Capitalized Interest on Equipment Financing | $0.9M |

| Underground Development & Infrastructure | $37.9M |

| Mining Pre-Operational Costs | $2.8M |

| Surface | $107.3 |

| Services | $66.9 |

| Supply | $35.2 |

| Surface Pre-Operational Costs | $5.2 |

| Owner’s Cost | $4.9M |

| Contingency | $19.6M |

| LOM Sustaining CAPEX | $100M |

| SUDENE Federal Tax Incentive (%, reduction in Corporate Income Tax) | 75% |

Article content

*Discrepancies in the totals are due to rounding effects.

Article content

Operating Costs

Article content

The operating costs of the Bandeira Project are estimated to be US$42.35 per tonne of ore processed. Total site operating costs are estimated at US$378 per tonne of 5.2% Li2O spodumene concentrate produced, placing it competitively among the global lithium industry. A breakdown of the operating costs is presented in Table 3.

Article content

Table 3. Project Operating Costs (OPEX)

Article content

| Operating costs(per tonne of ore processed) | $42.3/t |

| Mining | $26.2/t |

| Processing | $13.5/t |

| SG&A | $2.7/t |

| Operating costs(per tonne of 5.2% Li2O spodumene concentrate produced) | $378/t |

| Mining | $190/t |

| Processing + Tailings handling | $98/t |

| SG&A | $19/t |

| Capitalized Mining and Underground Primary Development | $70/t |

| Other costs | |

| Transportation costs to customer destination (Project Mine Site to Shanghai Port, China) | $119/t |

Article content

*Discrepancies in the totals are due to rounding effects.

Article content

Project Economics and Sensitivities

Article content

The after-tax NPV8% for the Bandeira Project is US$1.45 billion with a post-tax IRR of 61%, based on Fastmarkets’ 2025 long-term spodumene concentrate (“SC6”) price forecast, which assumes US$1,400/t SC6, CIF China, at production start expected in H2 2027 and a LOM average of US$2,200/t SC6, CIF China.

Article content

Article content

Sensitivity analyses completed as part of the FS demonstrate that the Project’s value is strongly influenced by the selling price of spodumene concentrate. As demonstrated in Figure 6, while capital (CAPEX) and operational (OPEX) costs impact the Net Present Value (NPV), their effects are relatively minor compared to concentrate price fluctuations. Given the expected increase in lithium demand, Bandeira is well-positioned to capitalize on favourable market conditions and benefit from rising spodumene prices.

Article content

Project economics remain robust under the most conservative SC6 price forecast available, as illustrated below. An average price of US$1,370/t SC6, CIF China, results in a post-tax NPV of US$583 million and an IRR of 33%.

Article content

The FS assumes a U.S. dollar to Brazil real exchange rate of US$1.00 to R$5.85, the median rate as determined by the top ten brokers by market capitalization.

Article content

The FS used a discount rate of 8.0% in calculating the net present value.

Article content

Lithium has become a critical driver of the global energy transition, with compound annual consumption growing at more than 25% over the past six years. While supply temporarily outpaced demand in 2023, long-term fundamentals remain strong as electric vehicle (EV) adoption accelerates worldwide. Independent market forecasts from Fastmarkets, Benchmark Mineral Intelligence, and the International Energy Agency (IEA) all support sustained demand growth for lithium, underscoring the attractive market backdrop for Bandeira.

Article content

Article content

Article content

Article content

Article content

Figure 6: Sensitivity Analysis for Spodumene 6.0% Li2O price, CAPEX and OPEX Estimation

Article content

Article content

Table 4. Post-Tax NPV and IRR Sensitivity to Spodumene Price

Article content

| Low Case | Base Case Fastmarkets base case | High Case | |

| LOM Avg Spodumene Price (SC6.0, CIF China) | $1,370/t | $2,212/t | $2,875/t |

| NPV8% | $583 M | $1.45B | $2.15B |

| IRR | 33.4% | 61.2% | 85.5% |

| Payback | 3.7 years | 2.2 years | 1.5 years |

Article content

Mineral Reserve Estimate

Article content

The Feasibility Study is supported by a Mineral Reserve estimate totaling 23.2 million tonnes at a delivered Li₂O grade of 1.10% (see Table 5) supported by the mineral resource estimate announced on May 6, 2025 (see Table 6).

Article content

Table 5. Mineral Reserve Estimate

Article content

| Deposit / Cut-Off Grade | Category | Resource (kt) | Grade (% Li2O) | Contained LCE (kt) |

| Proven | 2,571 | 1.12 | 72 | |

| Bandeira | Probable | 20,626 | 1.09 | 557 |

| Proven + Probable | 23,197 | 1.10 | 629 |

Article content

- The Mineral Resource dated November 20, 2024, is the basis for the Ore reserve

- Only the Measured and Indicated Mineral Resources have been considered as potentially economic for the mining study

- The Reserve has been validated by Hugo Filho (FAUSIM CP – 323096) in conformity with the CIM Estimation of Mineral Resource and Mineral Reserves Best Practices guidelines.

- The report adheres to the Canadian Securities Administrators’ NI 43-101 requirements.

- Figures are rounded to appropriate levels of precision, and discrepancies may occur due to rounding.

- The Reserve was calculated considering a cut-off of 0.5% Li₂O for underground resources and 0.3% for near-to surface ore.

Article content

Table 6. Mineral Resource Estimate (Effective date of November 20, 2024)

Article content

| Deposit / Cut-Off Grade | Category | Resource (Mt) | Grade (% Li2O) | Contained LCE (kt) |

| Measured | 3.36 | 1.38 | 114.7 | |

| Bandeira | Indicated | 23.91 | 1.33 | 786.4 |

| (0.5% cut-off) | Measured + Indicated | 27.27 | 1.34 | 901.1 |

| Inferred | 18.55 | 1.34 | 614.7 |

Article content

- The Mineral Resource Estimation (MRE) effective date is November 20, 2024.

- The MRE has been prepared by Carlos J. E. Silva (MAIG #7868) in conformity with the CIM Estimation of Mineral Resource and Mineral Reserves Best Practices guidelines.

- The report adheres to the Canadian Securities Administrators’ NI 43-101 requirements.

- Mineral resources are not mineral reserves and have not demonstrated economic viability. There is no certainty that any portion of the mineral resource will be converted into a mineral reserve.

- Figures are rounded to appropriate levels of precision, and discrepancies may occur due to rounding.

- The spodumene pegmatite domains were modelled using composites with Li₂O grades exceeding 0.3%.

- Grade estimation was conducted using Ordinary Kriging within Leapfrog software.

- The MRE is confined to the Lithium Ionic Bandeira Target Claims (ANM) and includes only fresh rock domains.

- The MRE was constrained by the Reasonable Prospects for Eventual Economic Extraction (RPEEE) using a grade shell with a cut-off of 0.5% Li₂O for underground resources.

- Inferred mineral resources are conceptual in nature and can only form the basis for economic analyses with further drilling and evaluation.

Article content

Article content

Permitting Update

Article content

While Lithium Ionic has made excellent progress advancing and optimizing the Bandeira Project, the receipt of the Licença Ambiental Concomitante (LAC) remains the next key milestone. Since the submission of Lithium Ionic’s application in late 2023, the review process has evolved in line with broader regulatory discussions currently shaping permitting across Minas Gerais.

Article content

In February 2025, the Minas Gerais State Secretariat for the Environment and Sustainable Development (SEMAD) issued a positive technical endorsement of the Bandeira Project. During subsequent review by COPAM (the State Council for Environmental Policy of Minas Gerais), a federal prosecutor requested to further evaluate considerations relating to a certain Quilombola traditional community located approximately 11 km north of Bandeira. While this community lies outside of the defined impact zone, the request reflects broader state-wide discussions regarding impact radii and consultation practices, recently raised by the Federal Public Prosecutors Office (MPF) across lithium projects in Minas Gerais. As the State of Minas Gerais remains the competent authority for environmental licensing, it is expected that the prosecutor’s queries will be addressed through the state review process before the Bandeira Project returns to COPAM for deliberation.

Article content

Article content

Lithium Ionic continues to actively engage with all relevant regulatory agencies, community stakeholders, and traditional communities, ensuring full compliance with Brazilian law and addressing evolving expectations transparently and proactively.

Article content

These broader deliberations present an important opportunity to strengthen regulatory clarity and reinforce environmental, social, and governance standards across Minas Gerais State. Lithium Ionic remains confident in a positive outcome for the Bandeira Project and in its ability to meet and exceed these evolving requirements. We believe that this process will ultimately enhance long-term certainty for Bandeira and support the responsible growth of the lithium sector in the region.

Article content

Project Advancement

Article content

The Project schedule uses conservative assumptions for permitting, equipment deliveries, and construction timelines. Subject to financing and a final investment decision, the expected start of operations will be in H2 2027, followed by a normal ramp-up profile for similar scale operations. The schedule incorporates proved technologies, including RTEK’s modular plant design, supported by their team’s extensive global experience in implementing DMS plants, including successful projects in Brazil.

Article content

Lithium Ionic intends to advance offtake agreements and secure project financing to support a final investment decision, paving the way for construction and successful commissioning.

Article content

Feasibility Study Contributors and Methodology

Article content

The updated NI 43-101 compliant Mineral Resource estimate was completed by GE21 (see May 6, 2025, press release). The subsequent mine design and NI 43-101 compliant Mineral Reserve estimate was completed in partnership with Datamine consulting services and validated by GE21. Mining costs were generated with contractor quotes and first principles for owner-operated portions of the execution.

Article content

Metallurgical testing was performed by SGS Geosol inclusive of pilot plant testwork referenced in the May 2024 Feasibility Study. Updated confirmatory testwork was performed by SGS with review and inputs from the RTEK team to support the updated 65.3% overall recovery estimate.

Article content

Lithium Ionic engaged Promon for engineering services related to site layout, Capex development and overall plant site design. Specific modular plant design services were provided by ADP (now acquired by Lycopodium). Construction planning, scheduling, and supporting capital costs estimates were provided by RETA.

Article content

Article content

Report Filing

Article content

The complete NI 43-101 technical report associated with the FS will be available on SEDAR+ at www.sedarplus.ca under the Company’s issuer profile, as well as the Company’s website at www.lithiumionic.com within 45 calendar days.

Article content

Qualified Persons

Article content

The updated Feasibility Study was completed with the support of representatives of experienced consulting groups including RTEK, Promon, RETA, GE21 and L&M.

Article content

The Qualified Persons (each a “QP”) are defined by NI 43-101 – Standards of Disclosure for Mineral Projects. Each of the QPs are independent of Lithium Ionic and the Project and have reviewed and confirmed that this news release fairly and accurately reflects, in the form and context in which it appears, the information contained in the respective sections of the Bandeira FS for which they are responsible. The affiliation and areas of responsibility for each QP involved in preparing the Bandeira FS are provided below.

Article content

| Section | Name | Role & Company |

| Mineral Resource Estimate | Carlos José Evangelista | Geologist – GE21 |

| Mineral Reserve Estimate | Hugo Filho | Mining Engineer – GE21 |

| Underground mine studies | Hugo Fliho | Mining Engineer – GE21 |

| Mineral processing studies | Noel O’Brien | Project Director – RTEK |

| Infrastructure studies | Juliano Lima | Technical Director – GE21 |

| Environmental studies | Branca Horta | Environmental Specialist – GE21 |

| Tailings Disposal systems | Juliano Lima | Technical Director – GE21 |

| Market studies and contracts | Porfírio Cabaleiro | Director – GE21 |

| Capex and Opex | Brian Talbot | Principal – RTEK |

| Economic and financial model was certified and validated | João Augusto Hilario de Souza | Director – L&M Advisory |

Article content

Article content

In addition, Brian Colin Talbot, of R-TEK International DMCC, a Qualified Person as defined by NI 43-101, has reviewed and approved the scientific and technical information contained in this news release.

Article content

Amendments to Select Land Positions

Article content

Lithium Ionic reports that it has amended the Borges agreement to expand one claim area by approximately 50 hectares, while releasing two other Borges claims and the Clésio claim back to the vendors in Minas Gerais, Brazil.

Article content

As shown in Figure 1, the updated claim status is as follows:

Article content

- Borges claim 831036/2005 extended by ~50 hectares, now totaling 364.38 hectares

- Borges claims 830980/2006 and 831352/2004 released, totaling 1,163.21 hectares

- Clésio claim 833592/2006 released, totaling 1,000 hectares

Article content

The decision to relinquish certain claims follows preliminary fieldwork and exploration that did not identify sufficient or high-quality drill targets to justify further investment or renewal. Conversely, the expansion of claim 831036/2005 reflects encouraging exploration results to date and a positive outlook for future work.

Article content

Following this adjustment, Lithium Ionic continues to control one of the largest land positions in Brazil’s “Lithium Valley,” comprising approximately 14,668 hectares, anchored by its flagship Bandeira Project, which is in advanced stages of permitting, and complemented by the Baixa Grande and Outro Lado deposits.

Article content

On

behalf

of

the

Board

of

Directors

of

Lithium

Ionic

Corp.

Article content

Blake Hylands

Chief

Executive

Officer,

Director

Article content

About

Lithium

Ionic

Corp.

Article content

Lithium Ionic is a Canadian mining company exploring and developing its lithium properties in Brazil. Its Itinga and Salinas group of properties cover 14,668 hectares in the northeastern part of Minas Gerais state, a mining-friendly jurisdiction that is quickly emerging as a world-class hard- rock lithium district. Its Feasibility-stage Bandeira Project is situated in the same region as CBL’s Cachoeira lithium mine, which has produced lithium for +30 years, as well as Sigma Lithium Corp.’s Grota do Cirilo project, which hosts the largest hard-rock lithium deposit in the Americas.

Article content

Investor

and

Media

Inquiries:

Article content

Article content

Article content

Cautionary

Note

Regarding

Forward-Looking

Statements

Article content

This press release contains statements that constitute “forward-statements.” Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such

forward-looking

statements.

Although

the

Company

believes,

in

light

of

the

experience

of

its officers

and

directors,

current

conditions

and

expected

future

developments

and

other

factors

that have been considered appropriate that the expectations reflected in this forward-looking information

are

reasonable,

undue

reliance

should

not

be

placed

on

them

because

the

Company can give no assurance that they will prove to be correct. When used in this press release, the words “estimate”, “project”, “belief”, “anticipate”, “intend”, “expect”, “plan”, “predict”, “may” or “should” and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information in this press release include information relating to the economic viability of the Project, prospectivity of the

Company’s mineral properties, future spodumene prices, future economic conditions, the Company’s ability to obtain adequate financing, the Company’s ability to obtain the requisite permits and approvals to develop the Project, ’the Company’s ESG initiatives and ESG performance, the Company’s exploration program and other mining projects and prospects thereof,

and the Company’s future plans. Such statements and information reflect the current view of the Company. Risks and uncertainties that may cause actual results to differ materially from those contemplated in those forward-looking statements and information. By their nature, forward- looking statements

involve known

and

unknown

risks, uncertainties

and

other

factors

which

may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The forward-looking information contained in this news release represents

the

expectations

of

the

Company

as

of

the

date

of

this

news

release

and,

accordingly, is subject to change after such date. Readers should not place undue importance on forward- looking

information

and

should

not

rely

upon

this

information

as

of

any

other

date.

The

Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

Article content

Information and

links

in

this press

release

relating

to

other

mineral

resource companies

are

from their sources believed to be reliable, but that have not been independently verified by the Company.

Article content

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this press release.

Article content

Article content

Article content

Article content

Article content

Article content

.jpg) 2 hours ago

2

2 hours ago

2

English (US)

English (US)