Article content

(Bloomberg) — European Central Bank President Christine Lagarde warned that international trade will be changed forever by the tensions over tariffs, even as the world’s leading economies edge toward some compromises.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Article content

“While it is fairly obvious that international trade will never be the same again, it’s also pretty clear that there will be further negotiations,” she said in an interview with the Canadian Broadcasting Corp. on the sidelines of the Group of Seven meeting of finance officials in Canada.

Article content

Article content

The gathering wrapped up on Thursday with a communique in which members glossed over their disagreement over the US administration’s tariffs.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The finance ministers and central bank governors focused instead on a collective call to address “excessive imbalances” in the global economy, an effort clearly aimed at China, though they didn’t name the country.

Article content

“There will be further movements on the part of all partners in the trade order to to probably reduce the major imbalances that we have and that we have had for a long time,” Lagarde said.

Article content

Speaking in a separate interview with Radio-Canada, the French-language public broadcaster, the ECB president said the impact of tariffs on inflation is hard to gauge for the central bank. There may be inflationary effects if Europe’s retaliation pushes up import costs, but in the short term there could also be deflationary impulses if there is a diversion of cheap Chinese goods into European markets, she said.

Article content

“The question of the impact of tariffs on inflation is very delicate,” Lagarde said. “There are lots of elements that are moving at the moment that we’ll be able to estimate the impact of as the negotiations advance.”

Article content

Article content

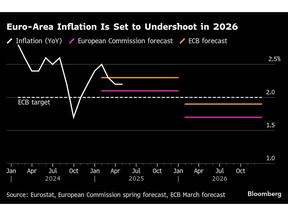

In the euro area, inflation held at 2.2% in April due to stronger underlying pressures. But analysts forecast a reversal in May — probably pushing inflation even below the ECB’s 2% target. The European Commission expects it to even average 1.7% next year.

Article content

ECB officials are widely expected to lower borrowing costs in two weeks, with inflation heading toward the 2% goal and US tariffs weighing on the economy. That would be the eighth reduction since June last year, bringing the key deposit rate to 2%.

Article content

Article content

—With assistance from Mark Schroers, Erik Hertzberg and Mathieu Dion.

Article content

(Updates with comments on inflation impact of trade tensions from 6th paragraph.)

Article content

.jpg) 5 hours ago

1

5 hours ago

1

English (US)

English (US)