Article content

(Bloomberg) — The European Central Bank is well placed to tackle “exceptionally high” uncertainty but will closely watch gyrations in commodities markets as tensions in the Middle East flare, President Christine Lagarde said.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

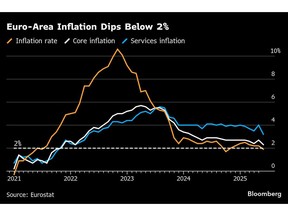

Addressing European lawmakers in Brussels, Lagarde said inflation is set to stabilize around the 2% goal and risks to economic growth remain tilted to the downside.

Article content

Article content

Article content

“At the current interest-rate levels, we believe that we are in a good position to navigate the uncertain circumstances,” she said Monday. “Especially in the current conditions of exceptional uncertainty, we will follow a data-dependent and meeting-by-meeting approach to determining the appropriate monetary policy stance.”

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The comments reaffirm Lagarde’s position after a weekend in which the US launched strikes on Iran’s nuclear infrastructure — sending oil prices higher and throwing the global economic outlook into question.

Article content

Article content

She acknowledged that the fighting in the Middle East could see a significant portion of energy supplies via the Strait of Hormuz impaired, risking secondary effects for prices.

Article content

“This is a source of concern and it’s a point that we have to monitor very carefully,” Lagarde said.

Article content

She also repeated that weakness in the dollar since President Donald Trump unveiled sweeping tariffs offers the euro an opportunity to boost its international standing.

Article content

After eight rate cuts in a year, ECB officials are weighing whether to lower borrowing costs further. While Lagarde said in early June that the easing campaign is nearing an end, some policymakers reckon more may be needed to support the 20-nation economy.

Article content

Surprisingly strong expansion of 0.6% at the start of 2025 was partly down to exporters front-running US tariffs. Data earlier Monday showed the euro zone’s private sector barely grew this month as trade and geopolitical uncertainty keeps companies from from investing and households from spending.

Article content

Investors and analysts reckon the key deposit rate will be left at 2% next month, but they’re leaning toward one more quarter-point cut before year-end.

Article content

“We are not pre-committing to a particular rate path,” Lagarde said.

Article content

(Recasts with more Lagarde comments.)

Article content

.jpg) 3 hours ago

1

3 hours ago

1

English (US)

English (US)