Article content

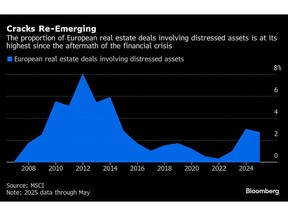

(Bloomberg) — King Street Capital Management has raised close to $1 billion for a fund to exploit the distress and dislocation that’s finally emerging in European real estate after the end of zero interest rates.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The firm’s European Real Estate Special Situations II fund reached its hard cap of $950 million of capital commitments within 12 months, according to a statement Monday. King Street has already deployed more than €1.5 billion ($1.2 billion) in European real estate debt and equity since interest rates ratcheted higher in 2022, partner and co-head of global real estate Paul Brennan said in an interview, and the latest fund raise will allow it to ramp up activity further.

Article content

Article content

Article content

“We’ve never been more active in European real estate than we are today,” said Brennan, who oversees the firm’s real estate investments in the region. “This is the most dynamic window since the financial crisis. The market dislocation is creating a rare window — especially in Europe’s most liquid cities — to access trophy assets at compelling entry points.”

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Many distressed debt investors who had hoped for bargains in Europe’s real estate correction have been mostly disappointed as lenders proved more patient than expected with landlords in breach of their debt covenants.

Article content

“We have seen little to no distress,” Charles Favard, head of EMEA real estate in UBS Group AG’s private funds group said. Where it has emerged, it has typically been in asset classes that few investors want such as “stranded office assets in secondary locations,” he said.

Article content

Instead, King Street has relied on a large in-house restructuring team and a detailed knowledge of the continent’s complex and varied bankruptcy laws to secure rare deals for trophy assets with broken capital structures.

Article content

Today an alternative asset manager managing $29 billion across a range of credit and equity strategies, King Street made its name as a hedge fund exploiting complex bankruptcies such as the collapse of Lehman Brothers since its founding in 1995. It’s now ramping up its European real estate bets with the help of a clutch of new hires including Michael Fuller from Brookfield, Adam Lawrence from Starwood Capital and Ranveer Bassey from Strategic Value Partners.

Article content

Article content

Among the deals it has done since rates blew out are the acquisition and sale of the Bauer Hotel in Venice, an asset that was part of the defunct Signa empire run by Rene Benko, who is now the subject of a criminal probe.

Article content

King Street bought into junior debt secured against the property, enforced a Luxembourg share pledge to take control and then quickly ran a process to sell it — a rare example of a special situations firm managing to make money out of the Signa bankruptcy. It eventually sold the property for more than €300 million.

Article content

“In the wake of Signa’s collapse, many market participants expended considerable energy chasing opportunities across a complex and unsecured capital stack,” Brennan said. “We identified a single asset where we had real structural protection in Luxembourg and focused our efforts there.”

Article content

King Street sold about 40% of its European real estate book in 2021 as the market boomed. The same year it raised a new dedicated real estate fund in excess of $1 billion but it struggled to deploy capital with prices elevated and almost no distress.

Article content

But as rates moved higher in 2022, the firm’s deployment ramped up as opportunities emerged. About a third of the firm’s global $2.3 billion special situations fund is also now invested in real estate.

.jpg) 8 hours ago

2

8 hours ago

2

English (US)

English (US)