Article content

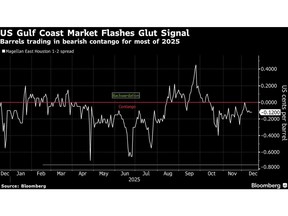

(Bloomberg) — A corner of the US crude market closely watched by physical traders is signaling oversupply in the latest indication that a global glut has reached domestic shores.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Light, sweet West Texas Intermediate at the Magellan East Houston terminal is trading 12 cents a barrel cheaper than later-dated oil in a bearish structure known as contango. What’s more, the Gulf Coast barrels have been in contango almost every day since October and show no signs of flipping even as suppliers try to drain inventories to avoid year-end taxes.

Article content

Article content

Article content

Oil traders see the Gulf Coast price structure as the new canary in the coal mine for the oil market, as the region houses the nation’s largest tank farm, refining hub and crude-exporting area. The signal of oversupply is particularly important for traders as WTI and Brent oil future prices remain in a stubbornly bullish, backwardated structure indicating market tightness. In the US, that’s in part because inventories that used to be held at Cushing — the delivery point for WTI futures — have shifted to the Gulf Coast.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“Cushing is less strategically important than it used to be,” said Robert Auers, an analyst with energy consultant RBN Energy LLC.

Article content

The regional glut is also showing up in floating storage: Oil loaded onto ships that haven’t moved in at least seven days is near the highest since the throes of the pandemic, according to Vortexa Ltd. The International Energy Agency is now forecasting of a record overhang of 3.8 million barrels a day next year.

Article content

While year-end tax rules are encouraging Texas oil holders to keep inventories as low as possible, tank farms will probably begin filling up again from January, according to traders.

Article content

Advertisement 1

.jpg) 11 hours ago

3

11 hours ago

3

English (US)

English (US)