Article content

(Bloomberg) — Before the trading day starts we bring you a digest of the key news and events that are likely to move markets. Today we look at:

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

- Earnings recovery

- MSCI inclusions

- Happy founders

Article content

Article content

Good morning, this is Ashutosh Joshi an equities reporter in Mumbai. Local stocks are set for a choppy session following President Donald Trump‘s threats to increase tariffs on India. That’s said, traders aren’t seriously pricing in much impact, for now, with Nifty futures holding steady in early trade amid gains in the broader Asian markets. Key earnings today include Bharti Airtel, Adani Ports and Britannia Industries.

Article content

Article content

Earnings recovery hope pushed to September quarter

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

A long-awaited recovery in corporate earnings still hasn’t arrived. As the first-quarter results season draws to a close, both Jefferies and Motilal Oswal have pointed to more profit downgrades for fiscal year 2026. Still, Indian equities have held up well in the face of four straight quarters of middling performance. Not all are pessimistic. Morgan Stanley expects a turnaround soon, and legendary emerging-market investor Mark Mobius is also upbeat, calling the Trump-era tariffs “short-lived.”

Article content

Consumer and energy stocks could join MSCI index

Article content

Despite broader uncertainty, there’s good news for investors in select stocks. According to Nuvama Alternative and Quantitative Research, companies like Vishal Mega Mart, Swiggy, Hitachi Energy India, and Waaree Energies are likely candidates for inclusion in the MSCI Standard Index, which is due for a reshuffle. Their likely addition signals rising global investor interest in India’s consumer, digital, industrial, and green energy sectors. If the changes go through, the brokerages expect passive flows of up to $270 million.

Article content

Article content

Founders emerge as winners in India’s deal boom

Article content

Meanwhile, company founders are making the most of a boom in India’s equity capital markets, paring their stakes via on-market deals. Promoter ownership in listed Indian firms fell to an eight-year low of 40.58% in June, according to Prime Database. The reasons vary — from profit taking, to more strategic reasons like debt reduction, legacy planning, and philanthropy. Whatever the motivation, founders are reveling in the moment.

Article content

Analysts actions:

Article content

- MCX Cut to Reduce at Avendus Spark; PT 7,900 rupees

- ABB India Cut to Add at Axis Capital Limited; PT 5,536 rupees

- Ajax Engineering Rated New Buy at Asian Markets; PT 861 rupees

Article content

Three great reads from Bloomberg today:

Article content

- Trump Vows to Ramp Up India Tariffs, Escalating Spat Over Russia

- Wall Street Is Warning Investors to Get Ready for Stocks to Drop

- Big Take: Russia’s Secret War and the Plot to Kill a German CEO

Article content

And, finally..

Article content

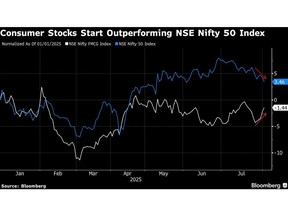

In a market weighed down by global trade worries, India’s cigarette and detergent makers are emerging as investor favorites. While the NSE Nifty FMCG Index gained 1.7% in July, the Nifty 50 fell 2.9%. Analysts cite easing rates, the lowest inflation in six years, and resilient domestic demand as key drivers. As global trade risks grow, consumer stocks offer a compelling mix of safety and growth for investors investing in India.

Article content

Article content

To read India Markets Buzz every day, follow Bloomberg India on WhatsApp. Sign up here.

Article content

—With assistance from Kartik Goyal, Chiranjivi Chakraborty and Savio Shetty.

Article content

.jpg) 2 hours ago

1

2 hours ago

1

English (US)

English (US)