Article content

(Bloomberg) — Before the trading day starts we bring you a digest of the key news and events that are likely to move markets. Today we look at:

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

- Signs of relief for telecom

- Lenders shine

- Tractors see strong demand

Article content

Article content

Good morning, this is Savio Shetty, an equities reporter in Mumbai. Earnings and trade developments are likely to dominate price action in Asian markets on Tuesday after MSCI’s gauge of global equities climbed to a record. At home, two Adani Group companies — Adani Green Energy and Adani Total Gas — are among those reporting results. The Nifty’s advance in Monday’s session means it is now less than 1% away from its all-time high. The gauge is likely to get there should this month’s momentum in foreign inflows continue. Global funds, which sold more than $9 billion worth of local shares on a net basis in the previous three months, have bought $1.3 billion this month through Oct. 24.

Article content

Article content

Top court verdict boosts telecom sentiment

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The Supreme Court’s decision allowing India’s government to reassess its demand for billions in past dues from Vodafone Idea Ltd. boosted the operator’s shares and lifted sentiment across telecom-related stocks. Greater clarity — and the prospect of a one-time settlement — could finally remove a major overhang on the industry, improving access to funding and supporting continued network investments. The ruling also supports banks by easing long-standing credit concerns tied to the sector. Bharti Airtel hit a record high, while Indus Towers climbed nearly 3%.

Article content

State-run banks could benefit from more FDI

Article content

Another cohort that could benefit from a potential policy change is state-run banks. Local media reports say India may more than double limits on foreign direct investment in state-run lenders, citing unidentified sources. If approved, the move would likely boost valuations and improve access to capital. A gauge tracking these stocks is already among this year’s best-performing sectoral indexes, and momentum could accelerate if the proposal progresses. Regulators appear increasingly open to overseas investment in the long-protected banking sector, with global lenders including Dubai’s Emirates NBD and Japan’s Sumitomo Mitsui Banking eyeing stakes in local banks.

Article content

Article content

Tractor sales in top gear

Article content

While some sectors are looking to favorable policies, one industry is already starting to reap rewards of a recent change. The local tractor market is witnessing a demand revival, with sales jumping almost 20% in the first half of the fiscal 2026. The government’s recent tax reduction and plentiful rains are powering demand, according to Systematix analysts. Growth is strongest in lower-horsepower tractors that offer cost efficiency and versatility. Rising sugarcane cultivation — supported by ethanol-focused policies — is also adding momentum. Mahindra remains the top listed beneficiary, with shares up 20% this year and on course for a sixth straight double-digit annual gain.

Article content

Analysts actions:

Article content

- IndiGo Reinstated Buy at Anand Rathi Securities; PT 7,000 rupees

- Federal Bank Raised to Buy at Nirmal Bang; PT 266 rupees

- eClerx Cut to Add at Equirus Securities Pvt Ltd; PT 5,115 rupees

Article content

Three great reads from Bloomberg today:

Article content

- Evercore’s Rainmaker Is Driving PE’s $200 Billion Bright Spot

- Latest US-China Trade Truce Leaves Fundamental Issues Unresolved

- Hong Kong Property Losses Hit PE Funds After $17 Billion Rush

Article content

And, finally..

Article content

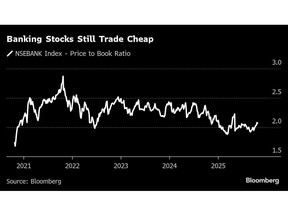

India’s banking stocks are gaining momentum, supported by rising open interest and appealing valuations. Despite the recent strength, the Nifty Bank Index’s price-to-book ratio remains below its five-year average, suggesting more room to run. As policies ease and capital flows improve, financials could anchor a year-end market surge.

Article content

Article content

To read India Markets Buzz every day, follow Bloomberg India on WhatsApp. Sign up here.

Article content

—With assistance from Alex Gabriel Simon and Ashutosh Joshi.

Article content

.jpg) 10 hours ago

2

10 hours ago

2

English (US)

English (US)