Article content

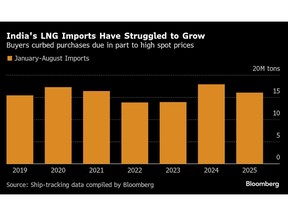

(Bloomberg) — India’s annual liquefied natural gas demand is set to contract in 2025 for the first time in years, as buyers hold out for a surge in production that is expected to push down prices.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The world’s fourth-biggest LNG importer bought about 16 million tons of the super-chilled gas in the eight months through August, down 10% from a year earlier, according to ship-tracking data compiled by Bloomberg.

Article content

Article content

Article content

Purchases slowed as elevated spot prices made LNG less competitive against alternative fuels, while monsoon rains brought cooler weather and reduced power demand. The pullback offers some relief to a global gas market that’s remained tight since Russia’s 2022 invasion of Ukraine forced Europe to pivot to LNG, boosting competition with Asia.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

India’s imports are expected to rebound as soon as next year, helped by a looming supply glut that should drag prices lower. Projects coming online from the US to Qatar starting in 2026 are set to add volumes that will outstrip demand growth through the rest of the decade.

Article content

“We expect the dip in 2025 is a temporary price-driven phenomenon,” said Kaushal Ramesh, vice president for gas & LNG research at Rystad Energy. “The years ahead will see more contracts ramp up and also lower spot prices.”

Article content

Demand for gas from industries, refineries and the fertilizer sector in the South Asian nation has plunged this year, according to oil ministry data, mainly due to high prices. Asian spot LNG has traded at more than $11 per million British thermal units this year — above the level at which price-sensitive Indian companies typically step in to buy.

Article content

Article content

Still, Rystad sees India’s annual LNG demand exceeding 40 million tons by 2030, compared with about 26 million tons last year.

Article content

The government has promoted gas for industries and households as a way to reduce the country’s dependence on dirtier fuels. India’s gas demand, half of which is met by imported LNG, could rise to as high as 365 million cubic meters a day by 2030, almost double the current level, according to a recent government study.

Article content

In fact, India has struggled to advance its goal of roughly doubling the share of natural gas in its energy mix to 15% by 2030 — a target that will require a surge in imports.

Article content

Investors are bullish, with LNG suppliers banking on that wave as they build new multi-billion-dollar export plants. Supply deals stretching several decades are also in the works as the glut is seen lowering prices.

Article content

Buyers, meanwhile, are already preparing for a future with higher gas demand. Importers such as Gail India Ltd. and Petronet LNG last week held talks with suppliers on the sidelines of the Gastech event in Milan for long-term supply deals, said people familiar with the matter, who didn’t wish to be named as talks aren’t public.

Article content

Shell Plc last month sought environmental approval for more than quadrupling its LNG import terminal on India’s west coast, while Invenire Energy Pvt. this month got permission to build a new facility on the east coast.

Article content

This year’s decline is temporary and doesn’t alter “India’s fundamental position as a key long-term growth driver in the global LNG market,” said Akshay Gupta, research analyst, gas and LNG markets, at Wood Mackenzie.

Article content

—With assistance from Ruth Liao and Stephen Stapczynski.

Article content

.jpg) 2 hours ago

3

2 hours ago

3

English (US)

English (US)