Article content

(Bloomberg) — HSBC Holdings Plc is expecting oil and gas deals to make up a smaller part of its energy portfolio, as renewables look to be the preferred way to feed data centers powering artificial intelligence.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Finance for fossil fuels will likely rise in absolute terms, but “decline materially” relative to HSBC’s overall capital allocations to the energy sector, Julian Wentzel, the UK bank’s chief sustainability officer, said in an interview. That’s due to “new energy systems coming on stream” over time, he said.

Article content

Article content

Article content

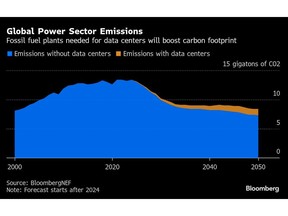

The comments are the latest to reflect how AI’s insatiable thirst for energy is reshaping capital allocations at major banks and asset managers. And while AI data centers are underpinning a revival of the green energy sector, they’re also feeding demand for oil, gas and even coal, which is ultimately making it harder to rein in emissions.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Against that backdrop, HSBC unveiled less ambitious targets for the carbon footprint of the financing it does. Instead of cutting absolute financed emissions by 34% by 2030, the bank now says it targets a reduction of somewhere between 14% and 30% by the end of the decade, compared with a 2019 baseline.

Article content

The bank disclosed the new targets in an updated version of its so-called transition plan, which was published on Thursday. Instead of aligning its high-carbon portfolio with a pathway for future emissions that limits global warming to 1.5C, the bank is now working within a target range with an upper bound of 1.7C.

Article content

Wentzel, who was appointed chief sustainability officer in February after overseeing HSBC’s global banking business for the Middle East, North Africa, and Turkiye, said fossil-fuel restrictions aren’t on the agenda.

Article content

Article content

“We all have to acknowledge that creating prohibitions or not acknowledging the reality of the environments we serve and the reality of the challenges that we have from an energy system don’t serve the transition,” he said. “We have to acknowledge that the removal of capital from the oil and gas sector doesn’t support the transition, because if they’re seeking to transition, we want to be party to and support that transition.”

Article content

HSBC said its new financed emissions target is still aligned with the goals of the Paris Agreement, but that it also “recognizes the inherent uncertainties that will continue to influence the pace of decarbonization across different sectors.”

Article content

AI is set to drive up the supply of all forms of energy, but renewables ultimately look better placed than fossil fuels to benefit, Wentzel said.

Article content

AI is a “huge shot in the arm” for low-carbon energy, he said. “This is a huge catalyst to the transition: It just takes too long to build the baseload required to deliver the energy requirement, so it’ll have to come through renewable sources,” said Wentzel. The resulting new energy system will be “very positively skewed to sustainable outcomes.”

Article content

Electricity demand tied to AI is on track to quadruple within a decade, with data centers on course to consume 1,600 terawatt-hours by 2035, or about 4.4% of global electricity. Renewables will play a major role in powering that development, though fossil fuels, especially gas, will also be a big part of the mix, pushing up emissions in the process, according to BloombergNEF.

Article content

Article content

Article content

.jpg) 2 hours ago

2

2 hours ago

2

English (US)

English (US)