Article content

(Bloomberg) — The Bank of Canada warned that a severe and long-lasting global trade war may cause more mortgage borrowers to fall behind on their payments — even beyond levels reached in the global financial crisis.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Article content

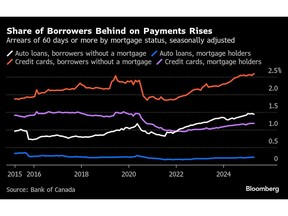

In its financial stability report published Thursday, the Canadian central bank said a prolonged trade dispute would reduce economic growth and increase unemployment. Here are three charts looking at the potential chain reaction, from businesses facing increased financial difficulties to households struggling to pay off their debt after layoffs.

Article content

Article content

Signs of financial stress are currently concentrated among households without a mortgage: Their rates of arrears on credit cards and auto loans have risen from a year ago and are above their historical levels. For households with a mortgage, rates of arrears remain below historical averages. Still, Governor Tiff Macklem said that if a large economic shock causes job losses, more households will struggle to keep up with debt payments.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The trade war is threatening jobs and incomes, particularly those tied to trade-dependent industries. Businesses that export a large share of their production to the US and have higher leverage, low profitability and low cash reserves are particularly vulnerable to a long-lasting trade war. Most of these firms are in manufacturing subsectors, including transportation equipment and primary metals.

Article content

Even though existing and new government support programs would likely help businesses and the economy in a prolonged trade war, some affected firms may still lay off workers as they adjust to lower demand. Canadians who face a large reduction in income after losing their job could have trouble repaying their debt.

Article content

According to the bank’s simulations, the share of mortgages in arrears by at least 90 days could rise to a level comparable with — or higher than — those seen during the global financial crisis.

Article content

Advertisement 1

.jpg) 5 hours ago

1

5 hours ago

1

English (US)

English (US)