Article content

(Bloomberg) — Hong Kong’s leader John Lee is expected to announce that the city is speeding up the development of a cross-border tech hub with China as the Asian financial hub searches for new growth drivers to revive its fragile economy.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The chief executive will deliver his annual policy address on Wednesday at 11 a.m., with the so-called Northern Metropolis likely to take center stage. The initiative aims to deepen integration with the mainland and transform the now sparsely populated region into an engine for innovation and advanced industries. The plan is part of a broader effort to diversify beyond the city’s traditional economic pillars of finance and real estate.

Article content

Article content

Article content

Lee’s fourth policy address will outline measures to accelerate the plan including easing financing restrictions, state-owned media Wen Wei Po reported, citing unidentified sources. The government intends to attract companies in industries such as artificial intelligence, renewable energy and medical technology to anchor the new district, the report said.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

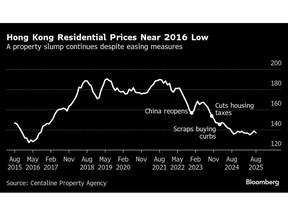

The apparent urgency comes despite tentative signs of a recovery. Hong Kong’s economy grew at its fastest pace in more than a year last quarter and fund-raising activity has picked up. Still, home prices have fallen for four consecutive years, bad debt is mounting and unemployment is at a three-year high.

Article content

The property industry proposed measures to boost the real estate industry, but initiatives discussed such as easing capital flows for mainland buyers or cutting property taxes aren’t on the agenda, according to the newspaper Sing Tao.

Article content

Reducing transaction levies would significantly erode fiscal revenue, making such steps untenable given strained public finances, said Kathy Lee, head of research at Colliers International, at a media briefing last week.

Article content

Article content

Monitoring cross-border capital in real estate is also more complex than in stock trading, raising concerns over potential capital flight or money laundering, Lee added.

Article content

Instead, the administration may revive the long-dormant Tenants Purchase Scheme, which allows public housing residents to buy their flats at discounted prices, RTHK reported. First launched in 1998, the program could help more locals climb the property ladder.

Article content

Absent bold new measures, Hong Kong’s housing market is likely to remain under pressure. Home values hover near their lowest since 2016, even as interest rates dropped to a three-year low in June. Oversupply and weak sentiment continue to weigh on demand.

Article content

Such dynamics could hurt listed developers, as greater housing supply and price softness erode margins, said Evan Ng, a portfolio manager at Chartwell Capital.

Article content

Still, property stocks may extend recent gains in the near term if Lee unveils stimulus to boost primary sales. A potential dip in mortgage rates following an expected US Federal Reserve cut could further aid developers such as Sun Hung Kai Properties Ltd. and Henderson Land Development Co. to sell homes, according to Bloomberg Intelligence’s Patrick Wong.

Article content

Hong Kong’s $7.2 trillion stock market, already surging on a liquidity-fueled rally, stands to benefit as the city’s leader touts more listings and capital inflows.

Article content

The economy grew 3.1% in April-June compared to the same period last year, the fastest pace since the end of 2023. However, the expansion is expected to slow in the rest of the year as the effect of export frontloading fades.

Article content

The city’s largest trading partner, mainland China, on Monday reported a broad slowdown in August, adding to signs of a sharp deceleration in the third quarter that likely affects its smaller neighbor.

Article content

.jpg) 2 hours ago

3

2 hours ago

3

English (US)

English (US)