Article content

(Bloomberg) — Global gas giants are betting the current lull in Chinese demand is temporary, and that the country will underpin their multibillion-dollar investments for years to come.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Article content

China’s gas imports have fallen in 2025, a decline centered on seaborne shipments of liquefied natural gas that slumped 22% through April from the previous year. Demand for LNG — the fuel carried in super-chilled tankers — is headed for its first annual drop since the height of the pandemic, just as new export projects are slated to come online, led by the shale gas fields of the US.

Article content

Article content

The problem is that LNG is being crowded out by cheaper alternatives such as coal and renewables, and gas produced domestically or piped overland from Russia and Central Asia. Slower economic growth and pressure to cut energy costs have also sapped China’s appetite for the fuel, which is generally a pricier option because of processing and shipping costs from plants as far afield as North America and the Middle East.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

But China’s willingness to diversify its supply of gas could also strengthen the seaborne market’s prospects, given the variety of sources it offers.

Article content

“China’s very strategic in their energy policy and their approach to energy,” said Meg O’Neil, chief executive officer of Australian gas producer Woodside Energy Group Ltd. “They diversify energy types, with significant investment in renewables, coal, nuclear, and natural gas. And within each of those commodities, they source from a number of different locations,” she said in an interview at the World Gas Conference in Beijing.

Article content

China has been the driving force in the global gas market for much of the past decade, accounting for more than a third of the total increase in consumption. That lifted the country from a minor player in LNG to the world’s biggest importer in 2021.

Article content

Article content

Since then, Chinese growth has faltered. The pandemic and the economy’s lackluster recovery; an energy crisis after Russia invaded Ukraine; the country’s breakneck adoption of clean energy and record coal output; and the success of its state-owned companies in raising domestic production, have all crimped overseas demand.

Article content

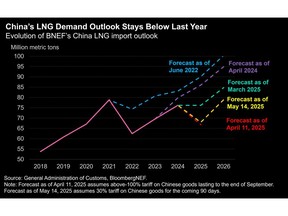

BloombergNEF expects China’s LNG imports in 2025 at 68 million tons, an 11% drop from last year. But there’s an expectation that expanded supply and cheaper prices will rekindle demand, Samantha Dart, co-head of global commodities research at Goldman Sachs Group Inc., told Bloomberg Television on Wednesday.

Article content

Growth Hurdles

Article content

Even though total gas supplies will rise faster than consumption, a research institute affiliated with China National Offshore Oil Corp. projects that LNG imports will double by 2035, according to a report released on Tuesday.

Article content

“China is trying to create additional supplies of gas,” Menelaos Ydreos, the secretary general of the International Gas Union, said in an interview at the conference. “Whether it’s domestic or LNG or whether it’s Russian gas, the demand is there.”

.jpg) 5 hours ago

2

5 hours ago

2

English (US)

English (US)