Article content

(Bloomberg) — The first US interest rate cut since President Donald Trump took office for a second term is likely to seize the spotlight in a week that will determine policy settings for half of the world’s 10 most-traded currencies.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Starting with the Bank of Canada and then the Federal Reserve on Wednesday, shifting to the Bank of England the following day, and ending with the Bank of Japan, central banks may either adjust borrowing costs, prime investors for their intentions in year’s final quarter, or both.

Article content

Article content

Article content

By the end of the week, rates affecting two-fifths of the global economy, including four of the Group of Seven industrialized nations, will have been tweaked or reaffirmed. A US rate cut long sought by Trump’s White House is expected to feature prominently.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The standoff over Fed policy, pitting Trump’s strident calls for lower borrowing costs against Chair Jerome Powell’s concerns about tariff-driven inflation, hangs over the meeting. Recent signs of weakening in the labor market have, however, given a green light for what most economists expect will be a quarter-point rate cut.

Article content

What Bloomberg Economics Says:

Article content

“We expect the FOMC to cut rates by 25 basis points. That won’t be because economic data on both sides of Fed’s mandate – price stability and full employment – warrant it. Rather, the markets expect a rate cut, the White House wants it — and we think Powell is doing what he sees as needed to fend off further threats to the Fed’s independence.”

Article content

—Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou and Chris G. Collins, economists. For full analysis, click here

Article content

Policymakers in Canada and Norway are expected to move rates by the same amount, while other advanced-economy counterparts may be more circumspect.

Article content

Article content

The BOE will probably keep rates unchanged after a cut in August that featured a rare three-way split among officials. The BOJ, meanwhile, remains on a path toward tightening but hasn’t signaled that such a step is imminent.

Article content

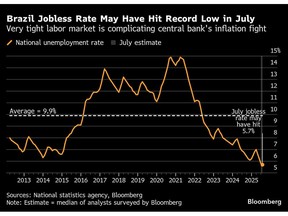

Central banks in other major economies are expected to maintain a watchful stance but not change rates. That’s the outcome forecast by economists for Indonesia, Brazil and South Africa.

Article content

Elsewhere, several economic reports in China, inflation data from Japan to the UK to Israel, Swiss export figures and a credit ratings review of Italy may be among the highlights.

Article content

Click here for what happened in the past week, and below is our wrap of what’s coming up in the global economy.

Article content

US and Canada

Article content

Before the Fed makes its decision on rates, they’ll get one last look at the American consumer. Retail sales on Tuesday are forecast to have risen 0.3% in August after much larger gains in the prior two months.

Article content

With the labor market on shaky ground and prices rising, it’s unclear how long shoppers will keep cracking open their wallets.

Article content

Economists will also keep an eye on jobless claims on Thursday to see if the jump in the prior week was a harbinger of a sustained deterioration in the labor market, or more of a one-off.

.jpg) 7 hours ago

4

7 hours ago

4

English (US)

English (US)