Article content

“The U.S. has benefited from reserve currency status for 100 years. It’s taken less than 100 days to unwind it,” says Gregory Peters, co-chief investment officer at PGIM Fixed Income. “It’s a very big deal.”

Article content

Article content

Article content

When Nixon’s Treasury secretary, John Connally, attended a G10 meeting in Rome shortly after the U.S. ended the dollar’s convertibility, the bombastic Texan told his shocked international counterparts: “The dollar is our currency, but it’s your problem.”

Article content

The Trump administration’s view is the opposite: the dollar is everyone’s currency, but America’s problem. And this is not as perverse as it might seem.

Article content

Despite Nixon severing the dollar’s link to gold in 1971, the greenback has remained at the centre of the monetary universe. In fact, thanks to the dollar’s importance in the expanding and increasingly interconnected global financial system, its importance has only grown. Far from eroding the dollar’s importance, the Nixon shock entrenched it in new ways.

Article content

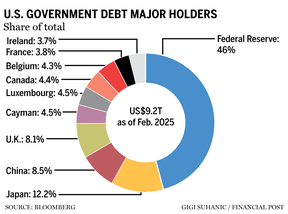

Nowadays, the U.S. only accounts for about a quarter of the global economy, but more than 57 per cent of the world’s official foreign currency reserves are in dollars, according to the International Monetary Fund (IMF). While much has been made of its relative decline in central bank reserves over the past few decades, the reserves statistics arguably underplay the dollar’s centrality. There are many other pots of sovereign and quasi-sovereign money that are not captured by the IMF’s data on foreign exchange reserves, and whether you are a bank in Mongolia, a pension plan in Chile, a European insurance group or a Singaporean hedge fund, dollars are the ultimate reserve asset.

Article content

Article content

The dollar is equally central in trade, with 54 per cent of all export invoices denominated in dollars, according to the Atlantic Council. In finance, its dominance is even more total. About 60 per cent of all international loans and deposits are denominated in dollars, and 70 per cent of international bond issuance. In foreign exchange, 88 per cent of all transactions involve the dollar.

Article content

While it is true that demand for dollars has kept our borrowing rates low, it has also kept currency markets distorted

Stephen Miran, chair, Trump's Council of Economic Advisers

Article content

Even physical U.S. bank notes are widely held abroad, thanks to the dollar’s broad acceptance. In fact, about half of the more than US$2 trillion worth of U.S. bank notes in issue are held by foreigners, according to the U.S. Federal Reserve.

Article content

This enormous international demand for dollars translates into an embedded premium to U.S. assets and means that the U.S. borrows more cheaply than it would otherwise do — what France’s former president, Valéry Giscard d’Estaing, once famously referred to as America’s “exorbitant privilege.” It also gives the U.S. the power to sabotage another country’s financial system through sanctions.

Article content

However, many in the Trump administration argue that the costs of the dollar’s reserve status outweigh the benefits, by making the U.S. currency unduly strong and hurting American exporters.

Article content

Article content

“While it is true that demand for dollars has kept our borrowing rates low, it has also kept currency markets distorted,” Stephen Miran, chair of the Trump administration’s Council of Economic Advisers, said in a speech last week. “This process has placed undue burdens on our firms and workers, making their products and labour uncompetitive on the global stage.”

Article content

Whether by accident or design, almost every action taken by the Trump administration in its first three months has hammered at the dollar’s support. Last week the DXY dollar index — which measures the strength of the currency against a basket of its biggest peers — fell 2.8 per cent. This was its seventh-worst week in the past three decades. It has kept dipping this week, extending its 2025 decline to 8.2 per cent.

Article content

“It’s not just that you can’t trust the U.S. any more, be it on geopolitics or trade,” says an American finance executive. “We have also managed to massively piss off the rest of the world. There’s genuine, personal animosity towards us, and that hurts the dollar.”

Article content

Article content

Most notably, the dollar has been particularly weak against other “haven” currencies that typically strengthen when markets are turbulent, such as the Swiss franc and the Japanese yen, and against gold. That the greenback is seemingly being excluded from this select club of currencies is a shocking development to many analysts and investors.

.jpg) 3 hours ago

1

3 hours ago

1

English (US)

English (US)