Article content

(Bloomberg) — Global gasoline markets are showing unusual late-summer strength as refinery outages limit supply, even at a time of year when demand for the road fuel usually wanes.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Refiners tend to make the most money in gasoline in the summer, especially in the US, as drivers take to the road for vacations. This year, margins are still strong even after the peak travel season, providing a boon for fuel makers.

Article content

Article content

Article content

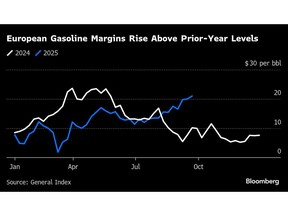

A barrel of gasoline is trading at a roughly $20.50 premium to an equivalent amount of West Texas Intermediate crude, up about $7 from the same time last year. That key measure of refiners’ profitability and gasoline-market strength has been rising since the US Labor Day holiday that marked the end of the peak driving season in early September.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“The global gasoline complex is enjoying a period of unusual support for September,” said Ines Goncalves, Kpler’s lead gasoline research analyst. Profits from turning crude into gasoline in the West reached their highest level this year in early September rather than in the peak demand months between May and August, Goncalves said.

Article content

Unplanned outages in Europe, West Africa and the Middle East between September and November are likely causing the gasoline market strength in the Atlantic basin, said Pamela Munger, Vortexa’s EMEA head of market analysis. But refiners also shifted yields, curtailing gasoline output to take advantage of a spike in the profitability of diesel, she said.

Article content

“The recent uptick in gasoline margins is a reflection of how sensitive prolonged supply outages can be even to an oversupplied market,” she said in a research note.

Article content

Article content

In northwest Europe, gasoline’s premium to crude is exceptionally strong for this time of year, according to figures from General Index.

Article content

Along with multiple refinery closures, Europe is contending with plant maintenance — some planned, some not — as well as reported ongoing disruption to a key gasoline-unit at the giant Dangote refinery in Nigeria.

Article content

At the same time, OECD Europe’s gasoline demand — supported by a shift away from diesel-fueled cars — has outpaced the five-year seasonal average every month so far this year, according to OilX data.

Article content

“While seasonally demand is coming off in September, refinery maintenance is ramping up globally, with hefty works in Europe and in the Middle East,” said Natalia Losada, an analyst at Energy Aspects. “Middle Eastern markets have been very strong all summer, providing an outlet for European barrels.”

Article content

In Asia, a key measure of refiner profits from making gasoline — the RON-92 crack — is trading above the five-year average. Multiple outages at refineries’ large gasoline-making units are tightening Asian markets, according to traders.

.jpg) 1 hour ago

3

1 hour ago

3

English (US)

English (US)