Article content

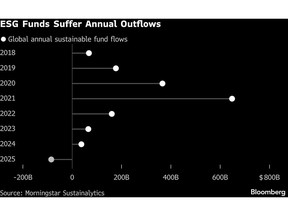

(Bloomberg) — Funds with ESG investment goals saw $84 billion in outflows last year, marking the first time the global market for such products was hit by net redemptions, according to a report by Morningstar Inc.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The historic pullback coincides with the first ever net withdrawals in Europe from products claiming to take environmental, social and governance factors into account, the report showed. In the US, meanwhile, ESG funds lost client money for a third consecutive year, Morningstar said on Wednesday.

Article content

Article content

Article content

“The wider environment remains challenging, as persistent headwinds, including geopolitical tensions, the ESG backlash, regulatory backpedaling, and mixed performance, continue to weigh on investor appetite,” Hortense Bioy, head of sustainable investing research at Morningstar Sustainalytics, said in a statement.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

US President Donald Trump’s explicit anti-environment agenda weighed heavily on the theme while regulatory uncertainty led to many funds dropping ESG labels in Europe. And concerns about greenwashing remain for many investments.

Article content

Fund outflows in Europe, by far the largest region for ESG investing, reached a net $20 billion last quarter as large UK institutional investors reallocated from pooled ESG funds into bespoke ESG mandates, Morningstar said. The hedge fund industry is also lobbying hard to ensure the UK excludes it from new climate regulations.

Article content

Passive ESG funds registered their first-ever annual outflows, losing close to $35 billion. Actively managed funds faced withdrawals of $49 billion, even as their non-ESG counterparts saw inflows.

Article content

The global retreat from ESG-labeled funds comes despite significant gains in clean energy stocks, with sales of green debt also hitting a record high. The S&P Global Clean Energy Transition Index soared more than 43% last year, with Jefferies Financial Group Inc. insisting that green investors are entering the “glory days” for such allocations.

Article content

Green stock gains offset some of the capital outflows, and global sustainable fund assets rose about 4% in the fourth quarter to $3.9 trillion, Morningstar said.

Article content

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)