Article content

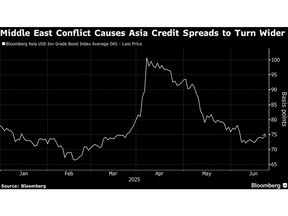

(Bloomberg) — Companies are rushing to raise debt in the wake of US airstrikes on Iranian nuclear sites, a sign the credit market is taking the war in the Middle East one step at a time.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The riskiest type of bank debt, perpetual corporate issues and large-size green bonds are all on offer across the world’s major markets on Monday.

Article content

Article content

That followed early morning chats between bankers and company officials, commonly referred to as go-no-go calls, where they discussed whether to wait in case they are blindsided by an Iranian response or to proceed with sales, according to people familiar with the matter, who asked not to be identified. Deal announcements in Europe then came later than usual, after 8:30 a.m. in London, they added.

Article content

Article content

The decision to go ahead underscores the muted reaction so far in global markets, with indicators of credit risk barely budging following the US attack. So far measures of credit risk imply investor worries are contained, with credit-default swap indexes mostly reversing their widening. Until there is an Iranian response that could destabilize sentiment, investors have cash and the willingness to buy.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“We will be there, putting orders,” said Thomas Neuhold, asset and fund management partner at Gutmann Kapitalanlagegesellschaft. Neuhold said he has been focusing on European and US issuers with little exposure to the Middle East in recent weeks.

Article content

Offers in the market include French lender BNP Paribas SA looking to sell a so-called Additional Tier 1 bond in US dollars, with initial price thoughts in the 8% area. Austrian oil group OMV AG is selling a hybrid bond and Royal Bank of Canada is offering benchmark-size green bonds in euros.

Article content

Europe’s primary market was expected to deliver a bustling pace of sales this week despite the geopolitical risks, according to a survey conducted by Bloomberg News on June 19 and 20, ahead of the weekend’s escalation. Over 60% of respondents expected sales to exceed €30 billion ($34 billion).

Article content

Article content

The iTraxx Europe index of investment-grade companies’ CDS is up just 0.2 basis points, while the Crossover tracker of mostly junk-rated firms is up less than 0.9 basis points. Earlier in the day, similar Asian indexes nudged higher but borrowers still marketed bonds in a sign that debt markets remain open in the absence of any further escalation.

Article content

Chinese energy company State Power Investment Corp. offered green preference shares, while Shandong Guohui Investment Holding Group Co. marketed dollar bonds. Elsewhere, Korean telecom firm KT Corp. brought a dollar security to market, and Hanwha Energy USA Holdings Corp. did the same with a green note offering.

Article content

Some investors are planning to ask for extra compensation when buying corporate debt.

Article content

“If we are adding credit, we would need a decent concession as a buffer to additional volatility,” said Pauline Chrystal, a fund manager at Kapstream Capital in Sydney.

Article content

There is an element of sell-while-you-can as it’s not clear how Iran might retaliate to the US airstrikes. A key consideration would be any effort by Tehran to disrupt shipping traffic through the Strait of Hormuz, a crucial passage for global oil and gas cargoes. Any such move would be a shock to the global economy and could put an end to the current spurt of bond sales activity.

Article content

“Issuers and syndicates could be made to pause if there is some kind of event — nobody would want to risk it,” said Gutmann’s Neuhold.

Article content

—With assistance from Ameya Karve and Andrew Monahan.

Article content

.jpg) 5 hours ago

1

5 hours ago

1

English (US)

English (US)