Article content

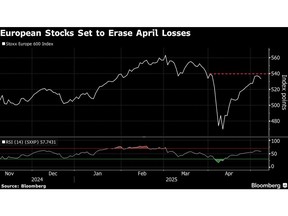

(Bloomberg) — European equities snapped a two-day losing streak on Thursday as investor confidence was boosted by a US-UK trade deal announced by US President Donald Trump.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Article content

The Stoxx Europe 600 Index rose 0.4% by the close in London. Most notably, the Euro Stoxx 50 rose to the highest closing level since April 2, Trump’s Liberation Day. Cyclical stocks such as industrials, technology, travel, retail and banks led the rally, while defensive equities such as utilities, health care and real estate were the biggest laggards on the day.

Article content

Article content

Chip stocks including ASML Holding N.V. rallied on a report that the White House plans to rescind some Biden-era curbs. Siemens Energy AG gained 3.3% after it said the impact of tariffs was going to be limited.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Hopes for a de-escalation of trade tensions were fueled as Trump said in the Oval Office he was “thrilled to announce that we’ve reached a breakthrough trade deal with the United Kingdom.” Full details of the pact would still be negotiated over the coming weeks, he said.

Article content

Under the agreement, the UK would fast-track American goods through their customs process and reduce barriers on agricultural, chemical, energy and industrial exports. UK stocks with US exposure, including Rolls Royce Holdings Plc. and Diageo Plc., gained.

Article content

Yet, a European Union proposal outlined hitting €95 billion ($108 billion) of US exports with additional tariffs if ongoing trade talks with the US administration were to fail.

Article content

The deal with the UK “is good news in terms of sentiment, but the reality is probably more complicated,” said Stephan Kemper, chief investment strategist at BNP Paribas Wealth Management. “My feeling is that we’re currently in the eye of the storm. I expect margins and EPS to ultimately take a hit.”

Article content

Article content

Broader sentiment was also buoyed by the Federal Reserve’s reassurance on the state of the economy Wednesday as it held rates steady.

Article content

“Powell gave a clear, consistent, if somewhat hawkish message yesterday, which keeps the credibility of the US Fed high and reassures investors,” said Thomas Wille, chief investment officer at Copernicus Wealth Management.

Article content

European stocks have clawed back most of their declines following Trump’s reciprocal tariff announcement on April 2, with his reversals and reprieves coming in a relatively upbeat earnings season.

Article content

For more on equity markets:

Article content

- Nascent UK Revival Could Gain Wings With BOE Boost: Taking Stock

- M&A Watch Europe: Sabadell, BBVA, Millennium, Prosus, BPER

- Germany Kicks Off 2025 IPOs With Pair of Small Deals: ECM Watch

- US Stock Futures Fall; Fluence Energy, Genpact, Fortinet Fall

- BAE Benefits: The London Rush

Article content

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

Article content

—With assistance from Michael Msika.

Article content

.jpg) 4 hours ago

1

4 hours ago

1

English (US)

English (US)