Article content

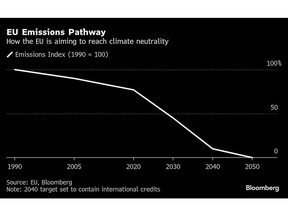

(Bloomberg) — A delay to the European Union’s new carbon-pricing system looks set to weigh on the outlook for inflation, potentially reviving calls for more interest-rate cuts.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

To help soften the impact of the bloc’s green transition, governments and lawmakers want to postpone rollout of Emissions Trading System 2, which imposes costs on polluters and is likely to make things like fuel more expensive.

Article content

Article content

Article content

Doing so would probably mean consumer prices rise less than currently forecast in 2027 — leaving the European Central Bank staring at another undershoot of its 2% target on top of the one it already expects next year.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

While ECB officials have largely agreed that borrowing costs don’t need adjusting to tackle existing challenges — including global trade and fiscal strain in parts of the region — the holdup in ETS2 could prompt calls from some to resume monetary easing.

Article content

“Without ETS2 taking effect in 2027, the inflation undershooting is likely to be larger in 2027, all else equal,” said Rune Johansen, an economist at Danske Bank. This “is an argument for favoring another cut,” he said, stressing that some officials would still push back.

Article content

The ECB’s latest quarterly outlook envisages inflation of 1.7% and 1.9% over the next two years. Bloomberg Economics reckons ETS2 provides a lift of 0.2 percentage point or more in 2027.

Article content

What Bloomberg Economics Says…

Article content

“Without the boost from ETS2, the forecasts would likely be closer to our own. With both the inflation impact and national implementation uncertain, the staff projections may lean on the optimistic side.”

Article content

Article content

—David Powell and Simona Delle Chiaie. Read here for full INSIGHT.

Article content

Before the next batch of forecasts, others have reached similar conclusions. The “concentrated effect in 2027 is now likely to be removed from the staff projections in December and replaced by a smaller effect in 2028,” JPMorgan’s Greg Fuzesi said.

Article content

The situation highlights how uncertainty beyond headline issues like Donald Trump’s tariffs and the Russia’s war in Ukraine is also complicating the ECB’s job. Six years on, commitment to the EU’s Green Deal is waning as governments ramp up defense capabilities and prioritize economic growth.

Article content

While sticking by a pledge to slash emissions by 2040, politicians fear higher energy costs could trigger a voter backlash. The ETS system caps emissions and lets companies trade allowances, with ETS2 designed to extend the concept to buildings and road transport from energy generation, aviation and others.

Article content

Quizzed last month about a delay, ECB President Christine Lagarde downplayed the danger, citing a European Commission proposal to spread the rollout over a longer period while still starting in 2027.

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)