Article content

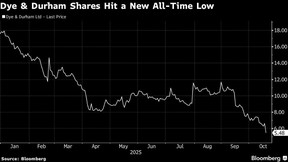

Investment company Plantro Ltd. withdrew a proposal to acquire legal software providerDye & Durham Ltd., saying the board didn’t show much interest in the idea. The shares plunged to a record low.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The offer was worth US$10.25 per Dye & Durham share, according to a statement Monday from Plantro, the Jersey-based firm of Matthew Proud, who’s the software firm’s former chief executive. That would have valued the company at nearly US$700 million.

Article content

Article content

Article content

“Plantro is evaluating its ownership position in Dye & Durham’s shares and may seek to reduce or exit its holdings,” the statement said. It held about 11 per cent of Dye & Durham’s shares as of early June, according to data compiled by Bloomberg.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Shares of Dye & Durham were down 19 per cent to $5.35 as of 1:14 p.m. in Toronto. Earlier they had fallen more than 21 per cent to reach the lowest intraday level since the company’s 2020 initial public offering.

Article content

Article content

Proud and Dye & Durham’s board have had a contentious relationship after he lost a proxy fight last year, resulting in his departure from the company. The sides reached a truce in July, when Dye & Durham’s board agreed to launch a review of strategic options, including a potential sale.

Article content

The company has faced a number of problems since then, including failing to meet the deadline for filing its financial statements for the fiscal year ended June 30.

Article content

Dye & Durham said Monday that it’s taking legal action in an Ontario court to enforce July’s “cooperation agreement” with Plantro and Proud. It said it has been evaluating Plantro’s takeover offer but that it has until Dec. 29 to start a process seeking initial proposals, and that it wants to have a “robust sales process.”

Article content

In its news release announcing the withdrawal of its offer, Plantro said Dye & Durham is suffering from deteriorating profitability and that the board didn’t engage with its takeover plan. Plantro also argued that Dye & Durham is at risk of a debt default by March 2026.

Article content

Article content

.jpg) 3 hours ago

1

3 hours ago

1

English (US)

English (US)