Article content

(Bloomberg) — It would be wrong to expect a persistent policy divergence between the US Federal Reserve and the European Central Bank, according to Executive Board member Isabel Schnabel.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

“I expect this trade conflict to play out as a global shock that’s working for both global demand and supply — we can discuss which of the two effects on inflation is larger because that that determines the net effect,” the German central banker said on Saturday.

Article content

Article content

Article content

“But in any case, I would not expect a sustained decoupling,” she said at the 31. Dubrovnik Economic Conference. “And this is also what you see in market pricing.”

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The ECB and the Fed raised interest rates in sync when inflation quickened in 2021 and 2022 and both started lowering borrowing costs in 2024. But while officials in Frankfurt cut eight times to 2% from 4%, with the latest move on Thursday, the US central bank has been on hold since December 2024, with the federal funds rate in a range of 4.25%-4.5%.

Article content

Fed officials are scheduled to meet June 17-18 in Washington and are widely expected to leave their benchmark rate unchanged. Many policymakers have said they want to wait for more clarity over how President Donald Trump’s policies on trade, immigration and taxation will affect the economy before they alter rates.

Article content

Despite diverging economic trajectories, inflation in the US and Europe shot up in the aftermath of the pandemic and retreated almost simultaneously after peaking in mid-2022. Some ECB officials including Schnabel have argued that inflation is becoming an increasingly global phenomenon.

Article content

Article content

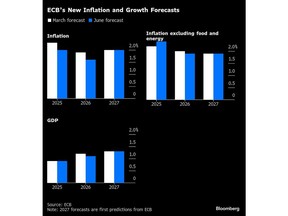

More recently, however, price growth on both sides of the Atlantic somewhat diverged. While proven to be more sticky in the US, it even eased below the ECB’s 2% target in May and is projected to average at 1.6% in 2026. At the same time Trump’s trade policies could raise prices in the US while it’s widely seen as disinflationary in the euro area due a weaker dollar, the softening of demand from slower global growth and the diversion of cheap Asian exports.

Article content

“The argument goes that if China can no longer export to the United States, they’re going to flood the rest of the world and especially Europe with cheap goods — and that could then lead to high inflation in the US and low inflation in Europe,” Schnabel said. “I would argue that this effect is actually quantitatively quite small.”

Article content

And even if “the effects were not small, you can be sure that there would be counteracting measures coming from the European Commission,” she said. “Therefore I would argue this is not an argument for divergence.”

Article content

President Christine Lagarde said Thursday that the cutting campaign is nearing an end as the ECB is now “in a good position” to navigate uncertainties ahead. Some officials see borrowing costs already at their final destination, according to people familiar with their thinking.

.jpg) 7 hours ago

1

7 hours ago

1

English (US)

English (US)