Article content

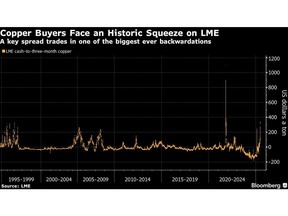

(Bloomberg) — One of the copper market’s biggest-ever squeezes is unfolding on the London Metal Exchange as rapidly declining inventories push up spot prices.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Spot copper traded at a $345-a-ton premium to three-month futures on Monday, hitting the highest level seen since a record spike in 2021. The huge spot premium — known as a backwardation — signals a supply shortage, and it comes after a rapid drawdown in LME inventories over the past few months.

Article content

Article content

Article content

Stockpiles in the LME’s warehouses serve as a buffer for manufacturers during periods of strong demand, while holders of short positions can also use them to close out their contracts. Backwardations typically indicate that the volume of stock in exchange warehouses is insufficient to meet their needs.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Readily available inventories on the LME have declined about 80% this year, and now equate to less than a day of global usage. The depletion has been fueled by a global race to move copper to the US ahead of potential import levies, in a dynamic that’s left buyers elsewhere increasingly short of metal.

Article content

To be sure, demand for copper has been slowing in recent weeks, and some Chinese smelters have moved to export surplus metal out into the international market to help replenish reserves. China’s inventories have also been drained as metal migrated to the US, where futures trade at a premium to the LME.

Article content

The LME last week formally introduced measures designed to prevent a backwardation if it’s fueled by individual traders who’ve taken large positions in front-month LME contracts.

Article content

Article content

Those measures have been used in the aluminum market in recent weeks, with Mercuria Energy Group Ltd. being compelled to lend back a large position at a capped level to prevent front-month spreads from moving into backwardation.

Article content

But trading data from the LME signal that a more deeply rooted squeeze is taking hold in the copper market, with movements in key short-term spreads on Monday indicating that price moves weren’t being influenced by any single large trader.

Article content

The LME also has rules forcing traders with large spot positions to lend them back to the market on a short-term basis at a capped rate, and they kick in when individual entities hold positions in stockpiles and spot contracts that are equal to more than 50% of available inventories. They compel them to lend their positions back on a one-day basis via the so-called Tom/next spread at a small premium to the spot copper price, starting at 0.5%.

Article content

On Monday, that would have meant that that the Tom/next spread would have been capped at $49.725 a ton if any one trader was subject to those rules. But at one point the spread spiked to $69 a ton, indicating that the lending provisions weren’t in effect, with broad-based buying setting stage for even bigger backwardations.

Article content

The pressure isn’t limited to nearby contracts either, with backwardations seen in key contracts through June 2026. That’s a stark contrast from conditions six months ago, when shorter-dated contracts were trading at a discount, indicating ample near-term supplies.

Article content

—With assistance from Jack Farchy.

Article content

.jpg) 6 hours ago

1

6 hours ago

1

English (US)

English (US)