Article content

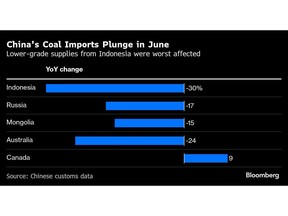

(Bloomberg) — Indonesia bore the brunt of a sharp fall in China’s coal imports last month, underscoring how Chinese power plants have shifted away from lower-quality fuel due to persistent domestic oversupply.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

China’s coal purchases in June plunged 26% from last year to 33 million tons, the least since February 2023. The decline was led by a 30% drop from top supplier Indonesia, whose shipments include a higher proportion of low-calorie lignite.

Article content

Article content

Article content

Although record local production has slashed China’s import requirements, the size of the decrease is striking given that electricity demand for air conditioning usually rises at this time of year. Moreover, the figures include relatively resilient purchases of steelmaking coal, indicating an even steeper drop-off in demand for the fuel used in power generation.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“Imports are likely to remain on a downtrend as Chinese power plants have to prioritize long-term trade commitments to domestic miners,” said local pricing agency cqcoal.com, which cited faster adoption of renewables and flagging industrial demand as dragging on prices.

Article content

That’s a particular problem for Indonesian exporters. Over the past three years, China has stepped up imports of lignite, or brown coal, from the Southeast Asian nation, blending it with higher grades for use in power stations. But the collapse in domestic prices to four-year lows has allowed utilities to source better-quality supplies more cheaply.

Article content

Moreover, the government in Jakarta is considering export levies on coal, which will only weaken the fuel’s attractiveness for buyers in China.

Article content

Article content

Some relief on domestic oversupply could be due. Beijing has warned it may shutter coal mines guilty of producing above permitted levels, in the latest sign that regulators are getting serious about reining in overcapacity across industries.

Article content

China’s imports of coking coal for steel, meanwhile, dropped 7.7% year-on-year to 9.1 million tons, although that figure was 23% higher than the previous month. With Australian shipments affected by weather disruptions, the relatively steady demand benefited China’s other big suppliers of higher-grade fuel, notably Mongolia and Canada.

Article content

The outlook for China’s beleaguered steel industry remains uncertain, though. While margins have improved at mills — supporting consumption of inputs such as iron ore and coal — government-mandated efforts to shrink steel capacity would ultimately undermine the markets for blast furnace ingredients.

Article content

On the Wire

Article content

China’s steel demand showed signs of recovery in the first half, rising 4.3% from a year earlier as gains in the auto and machinery sectors offset weakness in property, according to Bloomberg Intelligence.

.jpg) 7 hours ago

1

7 hours ago

1

English (US)

English (US)