Article content

(Bloomberg) — China’s oil refining sector is once again showing its knack for survival just as Beijing seeks to tackle industrial overcapacity.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Of three small refiners in Shandong province that went bankrupt last year, one has resumed operations under a new owner and the other two are in talks that could see them return, according to people familiar with the matter. All are seeking crude-import quotas from the central government, they added.

Article content

Article content

Article content

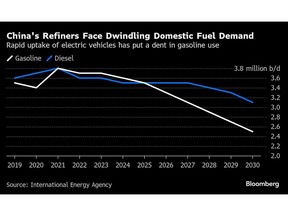

The revival comes as China vows to curb excess capacity across industries such as steel and solar, which has stemmed from factors including export-focused manufacturing and government subsidies. The issue is particularly pertinent to oil refining as the sector grapples with a likely peak in the country’s gasoline demand due to the uptake of electric vehicles and slowing diesel growth.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Prior to the bankruptcies in 2024, the three refiners were owned by state-run Sinochem Group Co. Independent operator Weifang Hongrun Petrochemical Co. acquired Shandong Changyi Petrochemical Co. this year and restarted operations in late June using domestically produced crude, according to traders and analysts who asked not to be identified as the matter is private.

Article content

Talks to acquire the other two — Zhenghe Group Co. and Shandong Huaxing Petrochemical Group Co. — are ongoing, the people said, declining to elaborate on the buyers. They added that the timing of their restart was unclear.

Article content

The long-term survival of the three refiners will likely hinge on crude-import quotas from Beijing, giving them access to cheaper oil, such as from Iran, that will help mitigate razor-thin margins. The central government has a long history of trying to consolidate the so-called teapot sector, but local government support and the exploitation of tax loopholes allowed them to thrive.

Article content

Article content

“The Shandong teapots have proved incredibly resilient,” said Michal Meidan, the head of China Energy Research at the Oxford Institute for Energy Studies. “Local governments and local financial institutions are heavily invested in the survival of their industries, at least until new growth drivers emerge.”

Article content

A Weifang Hongrun representative confirmed the acquisition of Changyi in March and said the refiner is in the process of applying for a quota to import crude, without elaborating. A spokesperson for Changyi confirmed the transaction, but declined to comment on import allocations.

Article content

Emails to Sinochem’s press office were unanswered, and nobody from the National Development and Reform Commission, and Ministry of Commerce replied to a fax seeking comment.

Article content

‘Questionable’ Economics

Article content

Changyi is seeking a crude-import quota of as much as 100,000 barrels a day, according to the people familiar. Collectively, the three oil refiners are asking for an allocation of up to 300,000 barrels a day, but the central government has yet to make a final decision, two of them added.

.jpg) 5 hours ago

1

5 hours ago

1

English (US)

English (US)