Article content

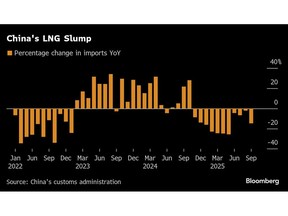

(Bloomberg) — Chinese demand for seaborne gas is poised to remain tepid through the winter, as ample supplies blunt the usual surge in consumption at the end of the year.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Imports of liquefied natural gas plunged 15% year-on-year in September, an 11th straight monthly decline. They’ve fallen 17% over 2025 so far, replaced by cheaper fuel arriving via pipeline or produced locally, and an abundance of other power sources like coal, solar and hydro.

Article content

Article content

Article content

A poor winter for LNG demand could come with a silver lining, however, if it gives importers the upper hand in price negotiations with squeezed producers down the line, according to analysts and executives, who spoke on condition of anonymity when discussing commercial matters.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

That could help put the industry on a more sustainable path, the people said, at a time when the global market is becoming increasingly oversupplied and China is still building import capacity.

Article content

The National Energy Administration expects the world’s biggest consumer of the fuel to record its slowest-ever demand growth of just 2%-3% this year. All of that will be met by the increased volumes being drilled domestically, or piped overland from Russia and Central Asia, the people said.

Article content

Economic Slowdown

Article content

China’s slowing economy is an obvious drag on consumption. And while cold snaps over the winter are always a risk to heating-fuel supplies, this year’s La Nina weather pattern is quite weak and may not be enough to disturb the general trend of rising temperatures.

Article content

Geopolitics are also playing a role. Major Chinese buyers have restocked their LNG tanks to as much as 80% of capacity to lessen competition for cargoes with a volatile European market over the winter, the people said.

Article content

Article content

Although China continues to take sanctioned Russian gas, the curbs are contributing to risk aversion among importers. Other factors, including potential instability on sea lanes in the Middle East and worsening trade relations with the US, are causing buyers to depend less on last-minute purchases from the spot market, the people said.

Article content

China has invested too much in LNG to let the market wither, though. Gas is viewed as an important backstop to intermittent renewables, and the industry has lobbied the government to dramatically raise the number of power plants that run on the fuel in the next five-year plan.

Article content

Helped by structurally lower prices, LNG would be part of that expansion. Import facilities could rise to 250 million tons a year by 2030, from 150 million tons currently, the people said.

Article content

On the Wire

Article content

President Donald Trump listed rare earths, fentanyl, soybeans and Taiwan as the US’s top issues with China, underlining the divisive topics the two sides plan to tackle at the negotiating table as a fragile trade truce nears its expiration.

Article content

China will phase out a long-standing platinum tax rebate for a state-owned giant, potentially opening up the market to new entrants.

.jpg) 3 hours ago

2

3 hours ago

2

English (US)

English (US)