Article content

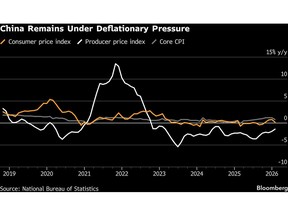

(Bloomberg) — China’s factory deflation eased more than expected in January, as downward pressure on prices moderates thanks to higher commodity costs and a crackdown on excessive competition among companies.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Producer prices fell 1.4% last month from a year earlier, their smallest decline since July 2024, according to data released by the National Bureau of Statistics on Wednesday. The median forecast of economists surveyed by Bloomberg was for a decrease of 1.5%.

Article content

Article content

Article content

After dropping for 40 straight months, the improvement in PPI “could be a positive signal for the market if we suddenly see the light at the end of the tunnel of these deflationary pressures on the production side of the economy,” Alicia Garcia Herrero, chief economist for Asia Pacific at Natixis SA, told Bloomberg Television before the data release.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The consumer-price index rose just 0.2% in January from a year earlier — a slowdown caused largely by base effects — after a 0.8% rise in December. Core CPI, which excludes volatile items such as food and energy, climbed 0.8%, its lowest level in six months.

Article content

China remains in the grip of deflation that’s eating away at income and profits. The country’s gross domestic product deflator declined for the third straight year in 2025, the longest streak since China transitioned toward a market economy in the late 1970s.

Article content

NBS statistician Dong Lijuan attributed the slower increase in CPI partly to the effect of a high base last year and said fluctuations in global oil prices contributed to a drop in domestic energy costs. The Lunar New Year, which tends to drive up spending by households, is a moving holiday that ran from Jan. 28 to Feb. 4 in 2025 but will fall entirely in February of this year.

Article content

Article content

Deflationary pressures have been present since the end of the pandemic, in large part as a consequence of a prolonged slump in housing and weak consumer demand.

Article content

A glut of production capacity in some industries has also led to oversupply, pushing firms to cut prices to survive. In response, the government has moved to curb cutthroat competition among companies — a campaign dubbed “anti-involution” — to stamp out the price wars that have been eroding corporate earnings in industries from electric vehicles to food delivery.

Article content

Authorities are making some headway in containing deflationary pressure. Major restaurant and beverage chains in China, including KFC and Cotti Coffee, are raising prices on food delivery platforms, retreating from years of discounting after regulators launched a probe into subsidies in the sector.

Article content

In monthly terms, producer prices have been rising since October, their longest streak since early 2022. That reflects a combination of factors, including the global rally in metals prices, government efforts to curb competition, as well as increased demand in electronics related to artificial intelligence, NBS’s Dong said in a statement.

.jpg) 1 hour ago

3

1 hour ago

3

English (US)

English (US)