Article content

(Bloomberg) — Washington’s efforts to choke Russian oil flows to India are raising the question of what will happen to the millions of barrels a day that would otherwise have been headed to the subcontinent.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

India’s state-owned refiners appear to be pulling back from spot purchases in the absence of official guidance from New Delhi, although what private processors will do is unclear. That potentially leaves a lot of oil — Russia sent about 1.7 million barrels a day to the South Asian nation last month — looking for a new home.

Article content

Article content

Article content

China, the most likely destination for the excess oil, doesn’t recognize unilateral sanctions, and takes both Russian and Iranian crude. But it also tends to fret about excessive dependence on a single supplier, and it’s uncertain if its refiners can absorb many more barrels at a time when the economy is not firing on all cylinders.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

President Donald Trump has also threatened to crack down on Russian flows to China, although it’s probably the only country with the economic heft and leverage — think rare earths — to resist the US.

Article content

“If anybody can do it, it’s the Chinese.” said Neil Crosby, an analyst at Sparta Commodities SA. “But if Trump starts to say he’s going to target China over Russian oil purchases, what is it worth to the Chinese to have a bit more Russian oil? I’m not sure.”

Article content

If a significant portion of the crude can’t find takers, the hit to supply could push global oil prices higher. The result could be a $10 to $20 a barrel increase, according to Capital Economics, basing its estimate on market moves in the wake of Russia’s invasion of Ukraine.

Article content

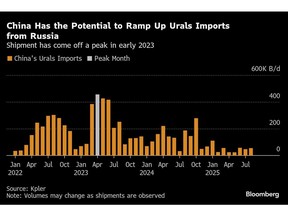

Chinese buyers are already being offered some cargoes of Russia’s flagship Urals grade for October arrival, according to traders with direct knowledge of the discussions who asked not to be named given the sensitivity of the trade. Refiners in China typically favor, and are geared up to process, the ESPO variety, which is loaded from Russia’s Far East, as well as cut-price Iranian crude.

Article content

Article content

Chinese processors could probably absorb around 400,000 to 700,000 barrels of Urals a day for their own refining, according to FGE and Kpler, although that could increase if the price of the grade drops further. But that still leaves a substantial amount of oil in the market.

Article content

Both ESPO and Urals are currently trading at premiums of around $2 to ICE Brent, a global benchmark, according to traders, although the transport costs for the former grade are a lot lower. Iranian crude, by contrast, is priced around $4 a barrel below ICE at the moment, said Muyu Xu, a senior crude analyst at Kpler.

Article content

The quality of Urals is worse than Iranian oil because of some metal content, she said. “That’s not something the teapots like,” Xu said, referring to Chinese independent refiners, who are major buyers of Russian and Iranian oil.

Article content

Another potential buyer of any displaced barrels of Urals is Turkey, which currently takes around 6% of Russia’s oil exports. However, its refineries may not be able to handle much more as raising the proportion of Urals in blends risks stretching their technical capabilities, according to Sparta’s Crosby.

.jpg) 3 hours ago

3

3 hours ago

3

English (US)

English (US)