Article content

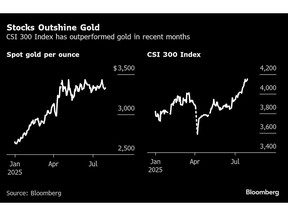

(Bloomberg) — Investors in China look to be pivoting from gold-backed exchange-traded funds into local equities, putting outflows on course for a record this month as shares push higher and bullion prices stall.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The four, major onshore gold-backed ETFs — Huaan Yifu, Bosera, E Fund and Guotai — have seen combined net outflows of about 3.2 billion yuan ($450 million) in July, according to data compiled by Bloomberg. At the same time, the CSI 300 Index has climbed 5.5%, its strongest showing since last September.

Article content

Article content

Article content

“Some investors are taking profits from gold and rotating into equities to chase stronger momentum,” said Steve Zhou, an analyst at Huaan Fund Management Co., which issues China’s biggest gold-backed ETF. Retail investors have been the main drivers of the outflows, he said.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

China is the largest physical bullion market, and while the nation’s ETFs are small compared with global counterparts, they are one of the easier ways for local investors to get exposure to the metal, and are a key barometer of sentiment. Access to investing in gold directly is limited since banks stopped the opening of bullion-trading accounts for individuals five years ago.

Article content

Gold has been one of the strongest performing major commodities so far this year, rallying by about a quarter on stronger haven demand, a weakening US dollar, and buying by central banks. Still, the bulk of that advance was concentrated in the first four months of 2025, with prices setting a record in April. Since then, they have largely tracked sideways, even as banks including Goldman Sachs Group Inc. have flagged potential for further gains.

Article content

Article content

At the same time, stock markets in China have responded positively to a high-profile push by the authorities to curb cut-throat price wars and what’s seen as excessive competition and overcapacity across the vast industrial sector. The drive to combat so-called involution is expected over time to improve profitability and corporate earnings, making equities more attractive.

Article content

To be sure, there’s no sure-fire way to determine that funds garnered from exits from gold-backed ETFs have been redirected into local equities. Aggregate inflows into equity ETFs in Shanghai and Shenzhen have been negative in recent weeks, although they would not capture stock-specific investments.

Article content

Chinese commodity stocks stand out as one group that’s risen. After lagging the broader market for three years, the sector has emerged as a top performer this year, aided by the supply-side reform, as well as the recent launch of a $167 billion hydropower project in Tibet.

Article content

“My view is that equities are likely to stay strong in the near term, but gold probably won’t weaken much,” said Kenny Ng, a strategist at China Everbright Securities International. Eventually, China gold ETFs “may stay relatively steady, without any sharp inflows or outflows,” said Ng.

.jpg) 19 hours ago

1

19 hours ago

1

English (US)

English (US)