Article content

(Bloomberg) — The current earnings season has largely been a letdown for China’s big tech stocks, lowering the hurdle for Baidu Inc. to impress investors seeking a fresh angle on the artificial intelligence theme.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Article content

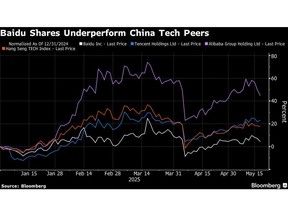

China’s top search engine had made early advances in AI but fell behind as DeepSeek shocked the world with its low-cost model and Alibaba Group Holding Ltd. grabbed headlines as well. Baidu’s shares are up 6% in Hong Kong this year, while Alibaba has surged 48% and the Hang Seng Tech Index has climbed 19%.

Article content

Article content

The street has drastically lowered its view on Baidu ahead of its results due later Wednesday, with the average 12-month analyst price target for the stock down 26% over the past year. It’s also now trading at a big discount relative to peers and historical levels.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

In a similar vein to Alphabet Inc.’s results beat last month, “if Baidu can build a strong case that search is not an ex-growth business and GenAI can boost its existing business including search, that will make the low expectation into the earnings play in favor of the stock price,” said Xiadong Bao, a fund manager at Edmond de Rothschild Asset Management.

Article content

China tech stocks have lost some steam since March’s DeepSeek-fueled peak amid concerns over tensions with the US, the health of China’s economy and Beijing’s stimulus plans. Recent earnings from Alibaba and Tencent Holdings Ltd. underwhelmed investors looking for a new catalyst.

Article content

Advertising still accounts for the bulk of Baidu’s revenue, and investors will be closely watching for clear signs of improvement in the macro-dependent business. UBS AG estimates its ad revenue declined 5.7%, a smaller drop than in the December quarter.

Article content

Article content

The slow ad recovery has been weighing on Baidu’s shares the most, said Kai Wang, a Morningstar Inc. analyst. “Once advertising comes back, Baidu’s valuation should come up pretty quickly, as that’s likely holding the AI business back,” he said. “It’s one of the few players in China that can actually build out the data centers and AI infrastructure, while its AI offerings with the Ernie model have improved.”

Article content

The stock’s underperformance has made it cheaper, currently trading at 8.6 times forward earnings estimates, well below its longer-term averages as well as the Hang Seng Tech Index’s 16 times.

Article content

On the positive side, UBS, Morgan Stanley and others expect Baidu to post robust cloud sales growth of more than 20% for the three months ended March, extending the December period’s AI-driven momentum. Analysts project it will report a narrower decline in overall quarterly revenue and return to positive growth for the full year.

Article content

“Similar to other internet companies, Baidu got strong external demand after the DeepSeek launch in January, which drove cloud momentum,” Morgan Stanley analysts including Gary Yu wrote in a note. The company has benefited from “incremental demand” from the financial, utility and energy sectors.

Article content

Baidu unveiled upgrades to its flagship Ernie AI models last month that are faster and cheaper than previous iterations as it battles rivals in the increasingly competitive AI market. Looking ahead, its push into robotaxi service is seen as a potential long-term growth opportunity.

Article content

For now it’s all eyes on earnings. Options traders are pricing in a 5.5% move in either direction for the shares after the results, compared with an average gain or drop of 4.2% fluctuation over the past eight quarterly reports.

Article content

—With assistance from Cecile Vannucci.

Article content

.jpg) 5 hours ago

2

5 hours ago

2

English (US)

English (US)