Article content

(Bloomberg) — A delayed snapshot of US inflation in September came in softer than expected, potentially offering a path for the Federal Reserve to cut interest rates beyond next week’s meeting.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The core consumer price index, excluding the often-volatile food and energy categories, increased 0.2% from August, according to Bureau of Labor Statistics data. The report was originally scheduled for release Oct. 15 but was delayed because of the ongoing US government shutdown.

Article content

Article content

Article content

Prime Minister Mark Carney said on Friday Canada is prepared to resume trade talks “when the Americans are ready,” hours after US President Donald Trump halted negotiations between the two countries.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy, markets and geopolitics:

Article content

US & Canada

Article content

In the absence of other official reports during the government shutdown, the highly anticipated reading was a welcome surprise, particularly for several policymakers who are leery of cutting rates further. While the central bank was already widely expected to lower borrowing costs at next week’s meeting, investors are betting the report will help convince officials that they can do so again in December — especially if they don’t get another CPI report next month.

Article content

Canadians are increasingly downbeat on the economy as a trade war with the US grinds on, putting pressure on a range of key industries. US and Canadian negotiators had been making headway in talks about the steel, aluminum and energy sectors, Carney said. “We stand ready to pick up on that progress and build on that progress when the Americans are ready to have those discussions.”

Article content

Article content

Asia

Article content

China’s factories kept the country on track to reach this year’s growth target, powered by an export boom that’s papering over deeper vulnerabilities as leaders meet to chart the nation’s next half-decade. The world’s second-largest economy grew 4.8% in the third quarter compared with a year earlier, slightly above estimates. But a closer look at the data shows the picture is far less reassuring.

Article content

Waiting times for commodity vessels queued off China’s ports increased to the lengthiest this year, as geopolitical sparring between Beijing and Washington disrupts global trade.

Article content

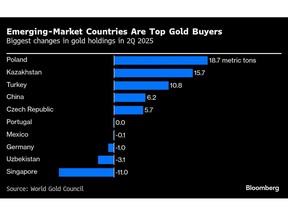

Emerging Markets

Article content

Argentina is on the cusp of midterm elections that threaten to derail President Javier Milei’s radical free-market experiment and plunge the nation back into crisis once again. All across the country, from downtown Buenos Aires to the rolling forests that form its remote northeastern edge, Argentines are growing weary of the sacrifices Milei is asking of them.

Article content

A relentless surge in the price of gold is delivering windfalls across emerging markets, boosting investor confidence in countries that mine and buy the metal. In South Africa, home to the world’s deepest gold mines, stocks are on track for the best year in two decades, with shares of miners like Sibanye Stillwater Ltd., AngloGold Ashanti Plc and Gold Fields Ltd. tripling in value.

.jpg) 11 hours ago

2

11 hours ago

2

English (US)

English (US)