Article content

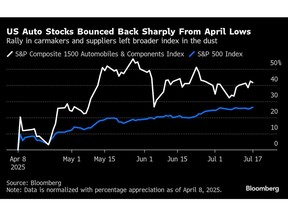

(Bloomberg) — Investors in auto firms, which sit squarely in the bullseye of US President Donald Trump’s trade war, are about to find out if earnings back up the sector’s scorching rebound from this year’s lows.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

A gauge of stocks of US carmakers and suppliers has soared more than 40% from its tariff-fueled April depths, handily beating the S&P 500 Index’s 26% gain. Meanwhile, the MSCI World Auto and Components Index has climbed 30% in that period, outpacing the MSCI World Index’s 25% advance.

Article content

Article content

Article content

Investors dove into the beaten-down shares during the furious rally unleashed when Trump paused most of his aggressive levies in April. But the recovery, which has since stalled out, creates a conundrum: While the shares are now much more costly, the tariff outlook hasn’t grown much clearer as the sector gets ready to announce quarterly profits starting next week.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Add to that headwinds around the affordability of new vehicles, rising global competition from Chinese brands like BYD Co., and China’s efforts to regulate the sector, and some analysts are wary of making broad bets on the industry at the moment.

Article content

“Auto stocks have bounced back, but the setup into earnings is murky,” said Keith Lerner, co-chief investment officer at Truist Advisory Services. “This is a market for selectivity, not broad exposure.”

Article content

General Motors Co., Tesla Inc. and Volkswagen AG release earnings next week, with Ford Motor Co., Stellantis NV, Mercedes-Benz Group AG and BMW AG coming the week after. Japan’s Toyota Motor Corp., the world’s No. 1 carmaker, and China’s Geely Automobile Holdings Ltd. are due to report next month.

Article content

Article content

‘Fluid Situation’

Article content

Most companies are poised to announce numbers for the three months through June — after a stretch in which Trump unveiled a slew of tariffs on auto imports, goods from Mexico and Canada, steel and aluminum and nearly all US trading partners. Many of the measures have been paused, but this month brought a fresh blow as Trump announced tariffs on copper and unleashed ultimatums on counterparts including Japan, Brazil, the European Union and Mexico.

Article content

The impact of the potential tariff regime on automakers, which have a sprawling global supply chain and are uniquely exposed to the risk, is a key theme investors and analysts will be watching.

Article content

“It is a fluid situation still and investors were not really prepared for the latest round of tariffs that were announced earlier this month,” said Garrett Nelson, an analyst at CFRA Research. He has a hold-equivalent rating on the US auto sector, citing valuations and tariff-related uncertainty among other reasons.

Article content

Wall Street is already lowering expectations for some of the biggest carmakers. Analysts’ second-quarter average profit estimate for GM has dropped 18% over the past six months and Ford’s has sunk 30%, according to Bloomberg Intelligence.

.jpg) 3 hours ago

1

3 hours ago

1

English (US)

English (US)