Article content

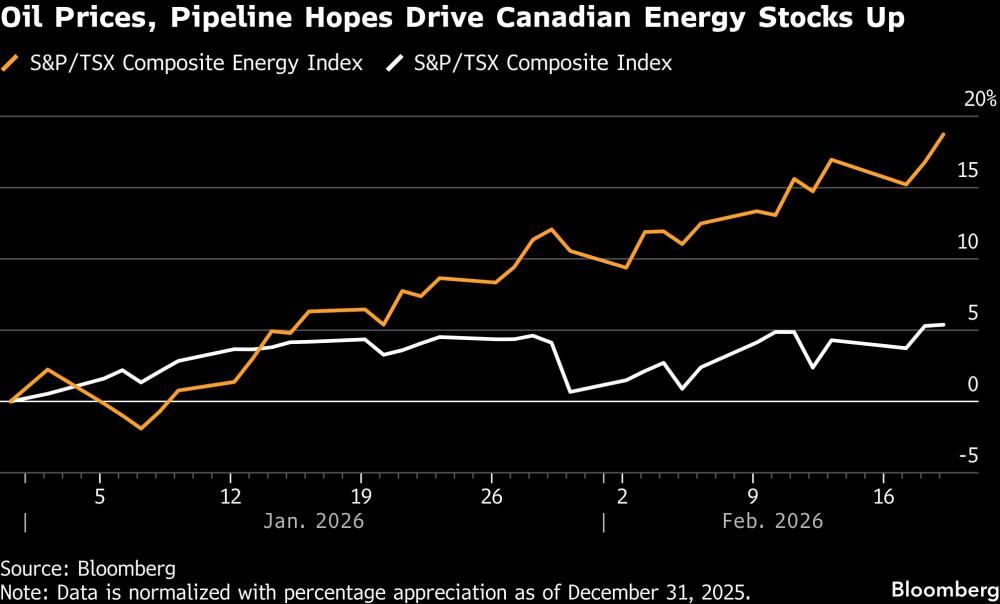

Canadian energy shares are poised for their first record close in nearly eighteen years, helped by rising oil and natural gas prices and a return of investor interest in the sector.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Oil surged this week as traders weighed whether U.S.-Iran talks will be enough to head off conflict after a report suggested U.S. military intervention could come sooner than expected. The S&P/TSX Composite Energy Index rose as much as two per cent on Thursday; if it holds, the group would finish at an all-time high for the first time since June 2008. The index is up 19 per cent this year, versus a 5.5 per cent advance for the S&P/TSX Composite Index.

Article content

Article content

Article content

Oil prices have risen on a run of geopolitical flash points involving Russia, Ukraine, Iran, Greenland and Venezuela. Brent crude futures are up 17 per cent so far this year. Natural gas prices also jumped early in 2026 as winter storms lifted demand.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“The fact that it’s taken well over a decade to return to the highs probably speaks to how long and persistent this sector was generally out of favor relative to some of the asset-light and higher growth sectors that are out there,” ATB Cormark Capital Markets research director Patrick O’Rourke said in an interview.

Article content

Government policy has also helped. Prime Minister Mark Carney has leaned into the country’s oil industry since taking office in March 2025 and his government signed a memorandum of understanding with Alberta in November that could clear a path for a new export pipeline, part of a broader push to diversify trade away from the U.S.

Article content

Article content

The new line could widen access to markets such as Asia and support higher output over time.

Article content

Canadian Natural Resources Ltd. shares are up 26 per cent this year, and O’Rourke said the company could benefit from any added capacity — though he also cautioned that big growth decisions tend to wait for clearer execution.

Article content

Article content

“Elements like the MOU that has been signed with Alberta are positive, but still I think at the end of the day, words are nice, but actions are a lot more meaningful,” O’Rourke said.

Article content

Read More

Article content

Energy stocks have also seen gains as their fundamentals have strengthened with balance sheets and profitability improving in recent years, according to O’Rourke. Companies have increased their capital discipline by improving their cost structure, increasing free cash flow and benefiting from lower cost of supply for Canadian oil.

Article content

Article content

Enbridge Inc. saw its earnings rise around eight per cent in 2025, while Suncor Energy Inc. saw its net debt fall by over 40 per cent last year.

Article content

Canadian energy stocks have also got a lift as traders moved away from investments pegged to environmental, social and governance frameworks amid rising geopolitical tensions, according to TD Securities research director Menno Hulshof. The shift muted the appetite for decarbonization-related themes, which would have led to a reduction in demand for traditional energy.

Article content

“The vast majority of energy investors would say that on balance energy security is a lot more important than transition and ESG, and we can debate whether that’s right or wrong, but that’s just the reality,” Hulshof said in an interview. “Most of our oil production is long life low decline, which of course has value for investors that believe that hydrocarbon consumption is going to last longer than a lot of people thought it would.”

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)