Article content

(Bloomberg) — Buy Contemporary Amperex Technology Co.’s Shenzhen-traded shares and sell their Hong Kong-listed peers, as the expiry of a sales ban on some early key investors approaches, according to JPMorgan Chase & Co.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

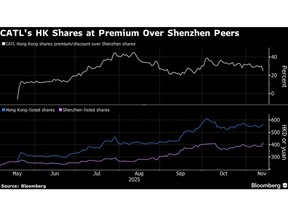

The cornerstone investors of the Chinese battery maker’s Hong Kong listing in May will be able to sell their holdings starting Nov. 19, potentially unleashing nearly 50% of the company’s so-called H shares outstanding, the US bank’s sales and trading desk wrote in a note. The expiry may act as a key catalyst for reversing the H shares’ premium over their onshore counterparts, according to the note.

Article content

Article content

Article content

CATL’s Hong Kong-traded stock has surged 116% since its debut six months ago, versus the 60% gain in its Shenzhen-listed A shares in the same period. Its H shares are now about 25% pricier than their onshore peers after adjusting for exchange rates, Bloomberg-compiled data show, marking a rarity as A shares typically command a premium over their Hong Kong peers for most dual-listed companies.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Among the supporting factors for the trade recommendation are likely muted demand for the world’s top battery maker’s H-shares given their premium and valuation concerns, JPMorgan wrote. The bank’s preference for CATL’s A-shares also comes as investor confidence grows in the battery sector’s demand outlook, especially that for the energy storage system.

Article content

READ: CATL’s 46% Rise in Hong Kong Sends Premium Over China to Record

Article content

“The current level looks compelling with CATL A/H being the lowest premium pair in the entire A/H universe and limited downside from here,” according to the JPMorgan note. Investors already with H-share positions could consider rotating into their mainland-listed counterparts, it added.

Article content

The US bank also noticed “surging short demand” for CATL’s H shares heading into the expiry of the cornerstone investors’ stock lock-up period, with approximately $1.5 billion of short positions outstanding and the bulk of them tied to the A/H-spread trade.

Article content

“Admittedly this is an extremely crowded trade,” JPMorgan added. “There is also high recall risk on the H-shares given extremely high utilization, although we do expect some of this to ease post lockup expiry.”

Article content

NOTE: Play CATL A/H Normalization on Lock-Up Expiry: UBS Sales Desk

Article content

.jpg) 1 hour ago

1

1 hour ago

1

English (US)

English (US)