Article content

(Bloomberg) — Stocks traders appear to be shrugging off the possibility of a hotter-than-expected inflation print on Tuesday, leaving them vulnerable if President Donald Trump’s trade war leaves its mark on US consumer prices.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

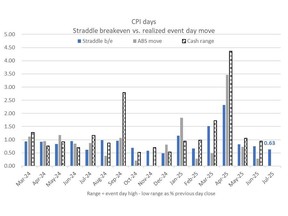

Bets in options markets show traders expect the S&P 500 Index to swing 0.6% in either direction following the 8:30 a.m. New York time release of June consumer price figures, according to data compiled by Citigroup Inc. That’s broadly in line with how much markets have moved during the last two CPI releases, when consumer prices rose less than expected. However, it’s well below the average realized move of roughly 0.9% over the past year on those days.

Article content

Article content

Article content

The recent stretch of tame inflation has helped fuel a roaring rebound in the S&P 500 while also stoking speculative fervor in riskier corners of the market. Yet economic forecasters say it’s only a matter of time before tariffs push consumer prices higher — a warning that bond investors appear to be heeding, even as stocks seem unperturbed.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“Yields have been rising this month, so fixed-income traders are concerned about this issue,” said Matt Maley, chief market strategist at Miller Tabak & Co. “However, stock traders are completely ignoring the possibility of higher inflation from the new tariffs. So, if the number is hotter than expected, it’s going give the stock market a surprising jolt.”

Article content

How stocks react to a potentially hotter-than-expected inflation number could offer insight into the staying power of a rally that has seen the S&P 500 gain roughly 25% from its April 8 low, with equities managing to hold their ground as Trump has delivered a fresh round of tariff threats. Signs of re-accelerating inflation would undercut the case for the Federal Reserve to cut interest rates in coming months and bring fiscal concerns back to the fore, giving investors a big reason to take profits.

Article content

Article content

That could prove even more the case for the market’s riskier stocks, said Dennis Debusschere of 22V Research LLC. A gauge of companies with the highest short interest is up 7% this month following a 16% jump in June, outshining the broader market.

Article content

However, “this is unlikely to continue short-term, not with inflation expectations increasing and tail risk to higher yields increasing because of policy risk,” he said.

Article content

Gamed Out

Article content

The data is already expected to come in higher than the prior print, with a headline 0.3% month-over-month increase forecast by economists surveyed by Bloomberg — up from 0.1% for May. The core June reading, excluding food and energy costs, is also estimated to rise 0.3%, more than the 0.1% in the previous period, according to the median estimate.

Article content

In gaming out CPI-day scenarios, JPMorgan Chase & Co. traders say the S&P 500 could drop up to 2% on Tuesday if the core monthly reading exceeds 0.37%, though they place only 5% odds on that happening.

Article content

The most likely scenario laid out by the team sees core CPI rising by between 0.28% and 0.32% from the month before, with the S&P 500 climbing anywhere between 0.25% and 0.75% in such an outcome. In the best-case scenario, also with 5% odds, a core month-over-month reading below 0.23% sparks a rally of up to 2%.

Article content

Andrew Tyler, the bank’s head of global market intelligence, said that higher consumer prices are likely coming. However, “it seems that we are at least a month away from having a print whose magnitude may spook the market,” he said.

Article content

—With assistance from Jessica Menton.

Article content

.jpg) 8 hours ago

2

8 hours ago

2

English (US)

English (US)