Article content

(Bloomberg) — Construction material suppliers’ strong earnings performance in the US probably faced a setback as the government shutdown and a lack of storms blowing off roofs stymied demand in the fourth quarter.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

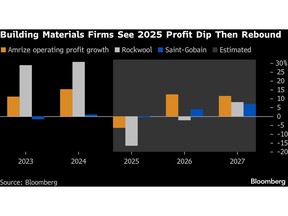

Providers of building materials with significant US exposure — including Chicago-headquartered Amrize Ltd., Denmark’s Rockwool A/S, and France’s Cie. de Saint-Gobain — are expected to report weaker earnings in the period, putting an end to a steady growth streak.

Article content

Article content

Article content

Buoyed by strong pricing and robust demand, courtesy of both a remodel boom after the pandemic and the increased frequency of severe weather, the $40 billion annual US roofing market saw 10% compound nominal growth from 2019 to 2024, Morgan Stanley analyst Cedar Ekblom calculated. In 2025, the market declined 8%, she said.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

No hurricanes made landfall in the continental US last year for the first time since 2015, a welcome reprieve for homeowners but a significant lull for construction companies.

Article content

Given that weather can drive as much as 35% of volumes, a lack of storm-driven demand combined with more subdued new build activity should have reverberated across the industry, Ekblom said.

Article content

Owens Corning — another major player in the US construction market — expects “the lowest roofing volume in about a decade” in the fourth quarter, Chief Executive Officer Brian D. Chambers said on an analyst call in November. Volumes in the next few quarters will be “pretty light relative to the last couple of years,” he added.

Article content

Saint-Gobain’s full-year operating profit should have declined about 1% in 2025, as the North America division sees “continued softness in new build, further weighted on by risk of roofing de-stocking from distributors,” according to Citigroup analyst Ephrem Ravi.

Article content

Article content

“Accelerated de-stocking in US roofing following a lack of storm activity in 2025 is likely to lead to weaker performance for stocks with US roofing exposure,” JPMorgan analyst Elodie Rall said, singling out Amrize in particular and removing it from positive catalyst watch ahead of earnings.

Article content

Shutdown Hit

Article content

The US government shutdown has also likely had adverse consequences, Rall added. There are already signs of the impact, with Sika AG reporting preliminary numbers that fell short of expectations earlier this month, which it partly blamed on the longest shutdown in US history.

Article content

“Global markets were soft in the fourth quarter, including US commercial construction trends, which were exacerbated by the government shutdown,” said the maker of bonding and sealing products for the building sector. JPMorgan’s Rall anticipates “continued earnings disappointments” from the company.

Article content

Morgan Stanley’s Ekblom expects weaker volumes to hurt the sector’s margins over the second half of 2025 and the first half of 2026, though she sees this as a “cyclical pullback” rather than the beginning of a structural retreat.

Article content

Long-term growth drivers — including aging housing stock needing upgrades, increasing storm frequency and severity requiring repairs, and an ongoing recovery in the housing market — are still “intact,” she said.

Article content

Construction companies with more diversified end markets like Saint-Gobain may also benefit from growing demand for infrastructure and energy transition projects, helping to offset more muted activity in residential and commercial construction, Bloomberg Intelligence’s Kevin Kouam said.

Article content

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)