Article content

Brookfield Asset Management sees the potential for more property acquisitions from real estate investment trusts in Singapore after its first deal in the city-state.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Article content

Many listed REITs in the country are trading at discounts to their net asset value, said Andrew Burych, managing partner and head of East Asia for the Canadian investment giant’s real estate group. It’s “pretty interesting to work with these REITs to see if there’s transactions we can do with them, so that they can recycle the capital into more core businesses,” he said.

Article content

Article content

Brookfield agreed last week to buy a S$535 million (US$414 million) portfolio from a REIT backed by Singapore state investor Temasek Holdings Pte, confirming an earlier report by Bloomberg. The two business park properties and two multistory buildings catering to biomedical and pharmaceutical industries are being sold by Mapletree Industrial Trust at a premium to valuation of about 2.6 per cent.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

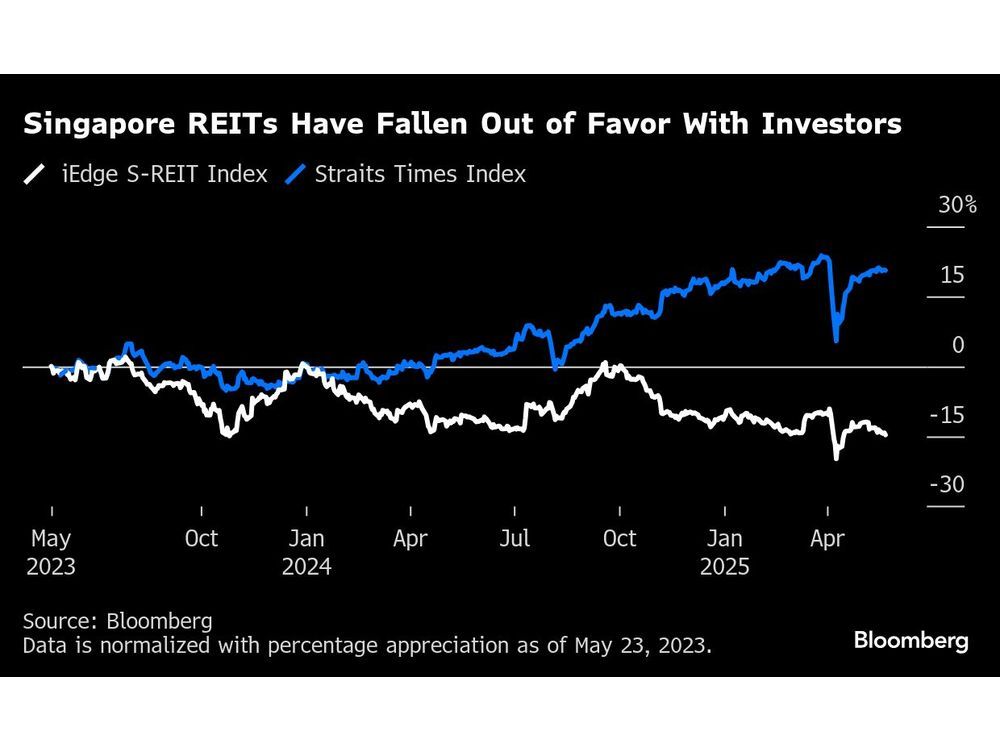

Singapore’s REIT market, one of the largest in Asia, has fallen out of favour amid high borrowing costs. An index that tracks the sector has declined about 15 per cent in the past two years, compared with a gain of nearly 21 per cent on Singapore’s broader equities gauge. The REIT benchmark trades at about 0.8 times book value.

Article content

Brookfield has sought to expand further in other developed Asian countries like Japan. In China, another major market for the firm, there’s a “lack of liquidity” amid the property crisis, which is influencing investment plans, Burych said.

Article content

The firm has also started an opportunistic Asia-focused real estate fund, which began deploying capital this year. A spokesperson declined to comment on which assets are being acquired under that fund.

Article content

Article content

In Singapore, Burych said Brookfield is interested in offices in the city center, though the right opportunity hasn’t come up. It bid on a worker housing portfolio but lost out to Bain Capital, Bloomberg News previously reported.

Article content

Article content

Read More

-

Brookfield weighing U.S. manufacturing investment

-

Brookfield files US$2.7 billion case against Peru

Advertisement embed-more-topic

Article content

Bets in the city-state aren’t without risk. Vacancies have surged in the business park sector as multinational companies cut back on space due to shifts toward work from home and cheaper locations outside Singapore.

Article content

The business park assets that Brookfield’s acquiring in the western Jurong area haven’t been immune to the slowdown. One of them, The Synergy, had an average vacancy rate of about 28 per cent, according to data from the REIT for the 2024-2025 fiscal year. Plans for the area have stalled after authorities rejected a bid last year from a group of property firms to develop a 6.5 hectare site, citing its low offer price.

Article content

Burych said Brookfield plans to deploy “meaningful capital” to enhance the portfolio, without elaborating. He said tighter regulations on other industrial spaces have led to higher vacancies, but the assets it’s acquiring have fewer restrictions on their use.

Article content

More industrial deals could be in store, though the firm hasn’t set a target, Asia-Pacific real estate head Ankur Gupta said in the same interview. Brookfield manages about $40 billion in real estate in the region and the Middle East, he said.

Article content

“We think there’s similar dynamics potentially with other groups that hold similar assets where we can continue to get more scale,” Burych said. “Part of our pipeline for Singapore is continuing on in that strategy.”

Article content

Article content

.jpg) 6 hours ago

1

6 hours ago

1

English (US)

English (US)