Article content

(Bloomberg) — Brazil’s only producing rare earth miner has given the US an option to acquire a stake in the company as part of a financing deal.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Serra Verde Group secured a $565 million loan with the US International Development Finance Corporation — an amount 22% more than initially approved by the agency’s board last year. The loan is to help cover upgrades to the company’s Pela Ema operations in Brazil’s Goiás state. The final terms, disclosed by the company, opens the door to US involvement in the closely held firm.

Article content

Article content

Article content

“It is an option for the US government to take a minority stake in the company, with no role in management,” Serra Verde Chief Operating Officer Ricardo Grossi said in an interview.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The Trump administration has been accelerating its backing of companies in the rare earth supply chain to counter China’s dominance in the sector, with the government offering loans and taking equity stakes in companies including MP Materials Corp. and Vulcan Elements. Meteoric Resources NL and Aclara Resources Inc., two developers with Brazilian rare earth projects, have also secured US financing, though at much lower amounts.

Article content

Talks between Serra Verde and the DFC have been ongoing for about 18 months, according to Grossi. The company is backed by Denham Capital, Energy and Minerals Group and the UK’s Vision Blue Resources Ltd.

Article content

The financing announcement comes after the Trump administration unveiled plans for a strategic critical minerals stockpile to insulate manufacturers from supply shocks as the US works to cut its reliance on Chinese rare earths and other metals. The venture, dubbed Project Vault, sets to marry $1.67 billion in private capital with a $10 billion loan from the US Export-Import Bank to procure and store minerals for automakers, tech firms and other manufacturers.

Article content

Article content

“It makes complete sense” for Serra Verde to be part of Project Vault, Grossi said, though such participation is still under discussion. “We view the initiative positively, as it could be a way to bring forward revenue for early-stage projects and help buy time until rare earth separation plants outside Asia mature.”

Article content

Grossi wouldn’t say whether the DFC funding will be tied to future supply deals, known in the industry as offtake agreements. Serra Verde is renegotiating rare earth supply agreements previously signed with Chinese customers, he said, with contracts expected to conclude by year end — opening the door to contracts with Western companies.

Article content

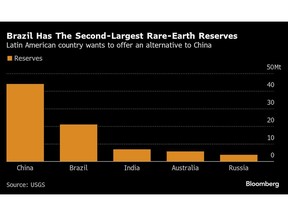

Brazil has the largest rare-earths reserves outside China and Serra Verde is the country’s only producer of those metals. Its Pela Ema deposit contains light and heavy rare earth elements — mainly neodymium, praseodymium, terbium and dysprosium – that are key to making magnets used in a wide range of applications.

Article content

Serra Verde began commercial output at its mine and processing plant in 2024. The company aims to ramp up annual output to 6,500 metric tons of total rare earth oxides by the end of next year. The company is considering doubling production capacity within the next four years.

Article content

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)