Article content

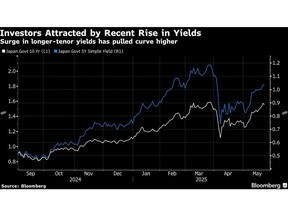

(Bloomberg) — Borrowers are finding a silver lining in this week’s surge in Japanese bond yields with higher rates attracting credit investors.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Article content

At least 10 issuers including drinks producers Kirin Holdings Co. and Suntory Holdings Ltd., as well as real estate company Mitsui Fudosan Co. and the Republic of Indonesia rushed to the market Friday. They priced more than ¥530 billion ($3.7 billion) of bonds in total, with maturities of mainly 10 years or less, in one of the busiest days this year.

Article content

Article content

The string of bond deals came after Japanese bond yields, especially for the longest tenors, moved sharply higher this week and made the offerings more attractive to investors. Some of the borrowers are returning to the market after delaying or canceling their planned deals in April as US tariffs rocked markets.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“Japan’s ultra-long interest rates are attracting global attention,” said Dai Otsu, head of debt syndication at Daiwa Securities Co. “For investors, even short-term bonds offer decent yields, and issuers prefer to raise funds at lower cost with shorter maturities rather than lock in high long-term rates.”

Article content

Data Friday showing that inflation in Japan accelerated at the fastest clip in more than two years on rising food and energy costs are also keeping Bank of Japan rate hikes in play, adding to the incentive for issuers in case yields on shorter-tenor notes rise further.

Article content

“Some Japanese corporate names might be worried about potential near-term BOJ rate hikes,” said Kit Lowe, a senior fixed-income analyst at InTouch Capital Markets. In addition, “Japanese names are looking to get ahead of market holidays on the US and UK on Monday.”

Article content

Article content

The spurt of issuance comes as Japanese sovereign bond yields, including those on 30- and 40-year debt, reached records. The benchmark 10-year yield is also just a few basis points short of its highest since 2008.

Article content

Read: Buyers Recoil From Japanese Bonds in Warning on BOJ Tapering

Article content

In the credit market, the pipeline is filling up. Fujifilm Holdings Corp. hired banks Friday for a potential ¥100 billion three-tranche deal as early as June.

Article content

“This favorable environment is expected to continue,” said Otsu at Daiwa Securities, one of the biggest underwriters of Japanese corporate bonds. “Many companies face upcoming redemptions and need funding, while the market is stabilizing and investor demand remains strong,” he said.

Article content

—With assistance from Umesh Desai.

Article content

.jpg) 8 hours ago

2

8 hours ago

2

English (US)

English (US)