Article content

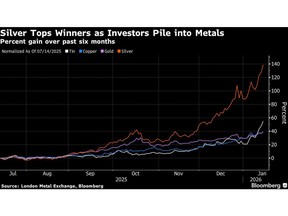

(Bloomberg) — Metals extended their dramatic start to the year — with gold, silver, copper and tin all hitting record highs — as investors bet on a boost from more US rate cuts and an economic revival in China.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Commodities have posted eye-watering gains since late-2025 as traders position themselves for a year in which the Federal Reserve is expected to cut borrowing costs further to bolster US growth. That’s aided the case for base metals that need strong manufacturing demand, while precious metals are also benefiting from renewed attacks on the Fed by the Trump administration and an increasingly tense geopolitical backdrop.

Article content

Article content

Article content

Silver jumped as much as 5.3% to top $90 an ounce for the first time on Wednesday, while gold racked up another all-time peak. Tin was the standout among base metals, and was up as much as 6% at one point, while copper also resumed its rally. All of those metals — apart from gold — are benefiting from the artificial-intelligence boom boosting demand for more energy infrastructure.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The so-called ‘debasement trade’ — in which investors avoid government bonds and currencies due to worries over ballooning debt levels — has underpinned the rally, especially in precious metals. A relatively weak greenback makes dollar-denominated commodities cheaper for many buyers. Gold rose 65% last year, while silver jumped almost 150%.

Article content

“When gold moves first, it usually signals declining trust in fiat currencies,” said Hao Hong, an influential Chinese market commentator who has backed metals in recent months. “Everything is measured against gold, then most assets look cheap right now, which is a strong tailwind for commodities, especially metals,” said the chief investment officer at Lotus Asset Management Ltd.

Article content

Article content

A more optimistic mood in Chinese financial markets has also helped, with investors piling into metals futures as well as equities in recent weeks. The latest trade data for Asia’s biggest economy showed exports booming, adding to other signs of resilience including busier factory activity.

Article content

Some metals — notably silver and copper — have been aided by the prospect of US import levies. The market is waiting for the outcome of the US Section 232 investigation, which could lead to tariffs on silver. Copper’s gains have also been partially driven by a looming White House decision on import taxes later this year.

Article content

“Fear about tariffs being added to silver has led to a large amount of silver getting stuck in the US, limiting flows into the global market,” said Liu Shiyao, an analyst at Zijin Tianfeng Futures Co. Ltd.

Article content

The latest gains in precious metals underline how strong investment flows have been, with speculative interest surging from Shanghai to New York. Trading volumes on the Comex and the Shanghai Futures Exchange have remained at elevated levels since late December.

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)