Article content

Bitcoin traded near two-month lows after Donald Trump named Kevin Warsh as the next Federal Reserve chair — a choice that did little to lift sentiment in a market already under pressure from persistent exchange-traded fund (ETF) outflows.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The largest cryptocurrency dropped as much as four per cent to US$81,045, its weakest level since November, before paring losses to around US$82,900. Some traders had hoped the Fed chair announcement might offer a narrative pivot. Warsh, a former central bank governor with deep establishment ties, has recently aligned with Trump’s push for lower rates. But his traditional background and prior hawkish record have left crypto investors unsure which version of Warsh will show up at the Fed.

Article content

Article content

Article content

Instead, a risk-off tone lingered over markets as the Warsh news circulated: stock turned lower, and the dollar traded just off four-year lows. With Bitcoin now down more than 34 per cent from its October peak — and United States spot ETFs on track for their longest streak of monthly outflows since launching — traders appear unconvinced that either macro or policy signals offer much near-term relief. Around US$1.8 billion in bullish positions across all tokens have been liquidated in the past 24-hours, according to CoinGlass data.

Article content

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“While his nomination would support the case that rates will continue to decline in 2026 through to 2027, Warsh is a career economist who is all too aware of reducing too much, too quickly,” said Hayden Hughes, general partner at Tokenize Capital.

Article content

Meanwhile, Binance announced that the exchange’s emergency insurance reserve fund known as SAFU will convert its roughly US$1 billion of assets held in stablecoins to Bitcoin over the next 30 days. The fund was established in 2018 to reimburse users in the event of security breaches or platform failures.

Article content

Article content

The 12 U.S.-listed spot Bitcoin ETFs have recorded three consecutive months of net redemptions which, if the trend holds through the end of January, will mark the longest sustained run of outflows since these vehicles launched in 2024. Some US$5.7 billion has been drained from the products over that period, according to data compiled by Bloomberg.

Article content

Article content

Article content

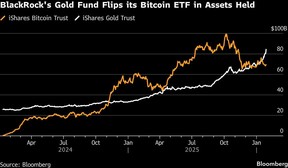

Bitcoin’s malaise contrasts with the recent surge in gold and other precious metals, as investors seeking refuge from geopolitical uncertainty shun cryptocurrencies in favour of traditional safe-haven assets. That’s raising doubts over claims the token functions as a kind of “digital gold.”

Article content

“Suddenly, cryptocurrencies no longer appear to be an alternative to fiat money and a hedge against the not-so-responsible financial policies of major countries,” said Alex Kuptsikevich, chief market analyst at FxPro.

Article content

Fund flows underscore the shift. BlackRock’s iShares Bitcoin Trust, the largest Bitcoin ETF, and one of the most successful fund launches ever, has fallen behind BlackRock’s Gold ETF in total assets.

Article content

One way to assess whether Bitcoin is fulfilling its potential as digital gold is to measure its value in the precious metal itself. On that metric it is failing, slumping some 60 per cent in gold terms from a late 2024 peak.

.jpg) 2 hours ago

2

2 hours ago

2

English (US)

English (US)