Article content

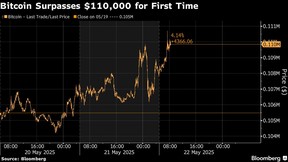

Bitcoin surpassed US$111,000 for the first time, with traders increasingly bullish on the prospects of the original cryptocurrency amid mounting institutional demand and support from U.S. President Donald Trump’s administration.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Article content

Bitcoin climbed as much as 3.3 per cent on Thursday to hit a record of $111,878, before falling just below $111,000 at 6:15 a.m. in New York. Smaller tokens also rose in a broad rally, with second-ranked Ether at one point up about 7.3 per cent.

Article content

Article content

A wave of optimism is buoying Bitcoin after the advancement of a key stablecoin bill in the U.S. senate fuelled hopes of greater regulatory clarity for digital-asset firms under Trump, who is avowedly pro-crypto. Surging demand from Michael Saylor’s Strategy, the former software maker until recently called MicroStrategy Inc. — which has stockpiled more than US$50 billion worth of Bitcoin — and a growing list of token hoarders is another driving force behind the rally.

Article content

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“It has been a slow motion grind into new all-time highs,” said Joshua Lim, global co-head of markets at FalconX Ltd. Buying by entities such as special purpose acquisition companies, or SPACs, is helping drive prices higher, Lim said.

Article content

Article content

An affiliate of Cantor Fitzgerald LP is working with stablecoin issuer Tether Holdings SA and SoftBank Group to launch Twenty One Capital Inc., a company that emulates Strategy’s business model. A subsidiary of Strive Enterprises Inc. co-founded by Vivek Ramaswamy is merging with Nasdaq-listed Asset Entities Inc. to form a Bitcoin treasury company.

Article content

“Unlike previous cycles, this rally is not momentum-driven alone,” said Julia Zhou, chief operating officer of crypto market maker Caladan. “It is quantitatively underpinned by measurable, persistent demand and supply dislocations.”

Article content

Article content

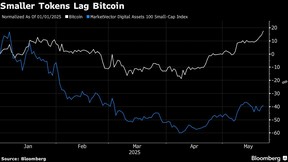

Bitcoin’s outperformance relative to smaller cryptocurrencies is widening. An index that tracks so-called altcoins is down about 40 per cent year-to-date, while Bitcoin is up 18 per cent so far in 2025.

Article content

Article content

A group of 12 U.S. Bitcoin exchange-traded funds have drawn strong inflows, with investors pouring in about US$4.2 billion so far in May. In options markets, traders built eye-catching Bitcoin positions earlier this week with the US$110,000, US$120,000 and US$300,000 calls expiring on June 27 logging the most open interest — or number of outstanding contracts — on Deribit, the derivatives exchange.

Article content

Article content

Tony Sycamore, market analyst at IG Group, said in a note that the fresh record shows that Bitcoin’s steep decline from a previous high set on Jan. 20 to below US$75,000 in April was “a correction within a bull market.”

Article content

“A sustained break above US$110,000 is needed to trigger the next leg higher towards US$125,000,” he added.

Article content

Bitcoin’s latest milestone comes as Trump prepares to meet with the biggest holders of his memecoin at a dinner at his golf club just outside Washington on Thursday. The event has raised concerns among ethics experts, who argue that it offers access through transactions that directly benefit the president, and has sparked criticism over potential conflicts of interest.

Article content

Such events “highlight crypto’s increasing cultural visibility, though they have not had a measurable impact on market dynamics at this stage,” said Yuan Rong Tan, a trader at QCP Capital Pte. Ltd.

Article content

Article content

.jpg) 4 hours ago

1

4 hours ago

1

English (US)

English (US)