Article content

Cryptocurrency investors waded back into the market last week, riding a surge in bitcoin.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Article content

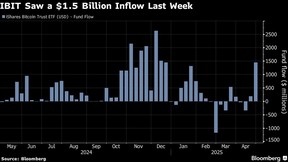

Exchange-traded funds tracking bitcoin and ether attracted more than US$3.2 billion last week, with the iShares Bitcoin Trust ETF alone seeing a nearly US$1.5 billion inflow — the most this year, data compiled by Bloomberg show. Other bitcoin-focused funds also saw meaningful infusions, with investors adding more than US$620 million to the ARK 21Shares Bitcoin ETF and about US$574 million into the Fidelity Wise Origin Bitcoin Fund.

Article content

Article content

Article content

Meanwhile, ether products posted their first net weekly inflows since February, according to data from Wintermute Trading Ltd.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The rally unfolded alongside a notable rise across risk assets, including the S&P 500, which last week gained 4.6 per cent amid optimism over potential tariff deals. Bitcoin itself surged 10 per cent to about US$94,000, its best week since the days following the U.S. presidential election.

Article content

Article content

Crypto enthusiasts also point out bitcoin’s resilience versus stocks during President Donald Trump’s trade war and the subsequent upheaval it has caused in financial markets. The token is flat this year, compared with the S&P 500’s nearly six per cent drop, a pattern that has reignited calls that the cryptocurrency is acting as a new type of safe haven akin to gold, which has also rallied.

Article content

“Net spot ETF inflows, which are a barometer of institutional interest in bitcoin, have ramped up,” eToro Group Ltd.’s Simon Peters wrote. “With gold at record highs, could investors also be seeing bitcoin, dubbed as ‘digital-gold’ due to its similar scarcity characteristics, as a potential safe haven or alternative asset to invest in if economic uncertainties continue on?”

Article content

Article content

IBIT, the largest bitcoin ETF with US$56 billion in assets, has had consistent flows this year, even as markets heave and shudder as Trump waffles between different tariff policies. In the background, the president has made moves to more forcefully embrace the crypto space: He will have dinner with the top 220 holders of the Trump memecoin, the issuers of the cryptocurrency announced last week, spurring a spike in its price.

Article content

Article content

Meanwhile, as Bitcoin surged in the wake of the election to above US$100,000 at one point, several analysts have upped their long-term price projections for the coin.

Article content

Michael Saylor of MicroStrategy Inc., rebranded as Strategy, who is a renowned Bitcoin bull, said he sees the coin going to US$13 million by 2045. At an event hosted by crypto asset-manager Bitwise Investment Advisers last week, Saylor made the far-out projection that the iShares Bitcoin Trust ETF (IBIT) will grow to be bigger than funds tracking the world’s largest and most profitable companies.

.jpg) 5 hours ago

1

5 hours ago

1

English (US)

English (US)