Article content

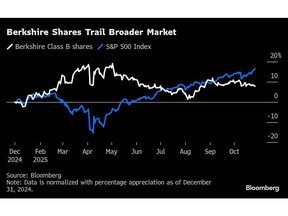

(Bloomberg) — Berkshire Hathaway Inc. got a rare sell rating, with analysts cautious on its earnings outlook and ongoing concerns over Warren Buffett’s upcoming departure and macro risks.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Keefe, Bruyette & Woods cut the recommendation on the conglomerate’s Class A shares to underperform from market perform, saying “many things moving in the wrong direction.” Among six analysts tracked by Bloomberg that cover the firm it is the only sell rating.

Article content

Article content

Article content

“Beyond our ongoing concerns surrounding macro uncertainty and Berkshire’s historically unique succession risk — think the shares will underperform as earnings challenges emerge and/or persist,” analyst Meyer Shields wrote in a Sunday note.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Earlier this year, the company named Vice Chairman Greg Abel to replace Buffett as chief executive officer. The billionaire, who recommended Abel for the job, will hand over the keys to the $1.2 trillion behemoth that Buffett built into one of the world’s most valuable companies on Jan. 1. Berkshire commands a portfolio of stocks such as Apple Inc. and American Express Co. on top of a collection of insurance, energy, railroad and consumer businesses.

Article content

Berkshire’s Class B shares trade about 1% lower on Monday. So far this year, the stock is up only 7.8%, compared to the S&P 500 Index’s 16% gain.

Article content

The succession might further weigh on the stock as “what we see as unfortunately inadequate disclosure that will probably deter investors once they can no longer rely on Mr. Buffett’s presence at Berkshire Hathaway,” Shields wrote.

Article content

He sees shares continuing to underperform as earnings challenges in several business units, including GEICO, Berkshire Hathaway Reinsurance Group, investment income, Berkshire Hathaway Energy, and Burlington Northern Santa Fe carry on or crop up.

Article content

“Believe GEICO’s likely underwriting margin peak, declining property catastrophe reinsurance rates, lower short-term interest rates, tariff-related pressure on the rails,” they wrote, adding that “the risk of fading alternative energy tax credits will drive underperformance over the next 12 months.”

Article content

.jpg) 3 hours ago

3

3 hours ago

3

English (US)

English (US)