Article content

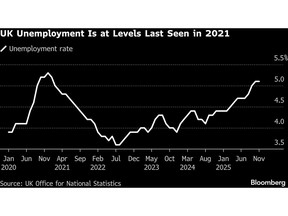

(Bloomberg) — The Bank of England is expected to keep interest rates on hold at 3.75% this week as policymakers weigh contradictory signs that the economy is both strengthening and losing jobs with unemployment at a near five-year high.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The Monetary Policy Committee is treading carefully having cut rates from 5.25% since August 2024. Its nine members remain divided over where they will settle — economists estimate the “neutral” rate to be between 3% and 3.5% — but minutes from the last meeting in December showed they have agreed to move more slowly barring an unexpected turn of events.

Article content

Article content

Article content

The big unknowns they face are the speed at which inflation will fall to the 2% target from its current level of 3.4%, and whether the recent weakening in the labor market is the start of something more serious. The central bank expects inflation to fall back toward the 2% target next quarter.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The new set of economic forecasts published in its quarterly Monetary Policy Report alongside the Feb. 5 rate decision will shine some light on those judgments, with the outlook for wages a key piece of the puzzle. The BOE’s agents survey of business contacts, whose findings on planned pay settlements are closely monitored, will be published at the same time.

Article content

“The labor market is front and center of the current policy debate,” Barclays Plc Chief UK Economist Jack Meaning wrote in a note.

Article content

Unemployment held at 5.1% in the three months through November, a rate last higher in early 2021. It suggests joblessness ended 2025 above the 5% the BOE predicted in November. At the same time, wage growth is set to undershoot the bank’s forecast for a fourth quarter running, Meaning said.

Article content

Although unemployment is raising concerns, the MPC is expected to hold rates until there is clearer proof inflation is on track for 2% on a sustainable basis. A jump in oil prices after US President Donald Trump threatened strikes on Iran would add 0.2 percentage points to inflation, Capital Economics warned.

Article content

Article content

Signs that the economy is picking up after back-to-back tax rises since Labour came to power may also persuade MPC members to downplay employment concerns.

Article content

Investec economist Philip Shaw said recent data is “unsupportive of a cut this time.” GDP rose by 0.3% in November and the composite purchasing managers index of business activity hit a 21-month high. “Neither points in the direction of spare capacity building up,” Shaw said.

Article content

Barclays and Investec are predicting a 7-2 split on the MPC, with external members Alan Taylor and Swati Dhingra dissenting in favor of cutting rates. Bloomberg Economics and Morgan Stanley see a 6-3 vote with Deputy Governor Dave Ramsden joining the rebels.

Article content

Traders, who are only fully pricing in one further cut this year, put the chance of move this week at virtually zero and economists agree. December’s quarter-point reduction was a close call, with Governor Andrew Bailey swinging the vote 5-4.

Article content

The decision along with the Monetary Policy Report will be published at noon on Thursday, followed by a press conference led by Bailey.

Article content

The forecasts are not expected to change much since the last assessment in November.

.jpg) 1 hour ago

2

1 hour ago

2

English (US)

English (US)