Article content

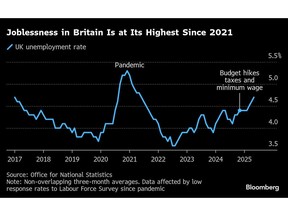

(Bloomberg) — The Bank of England is set to cut interest rates to the lowest level in over two years, as its policymakers contend with a slowing economy and a jobs market rattled by higher taxes.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Markets and economists expect the UK central bank to lower the benchmark rate by 25 basis points to 4%, sticking to its once-a-quarter pace of easing. It will announce the decision at 12 p.m. in London, followed by a press conference led by Governor Andrew Bailey half an hour later.

Article content

Article content

Article content

The Monetary Policy Committee has maintained a cautious approach to unwinding policy restriction amid a fresh spike in inflation. Updated forecasts are expected to show stronger near-term price pressures than predicted back in May.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

However, concerns over the economy are also mounting after back-to-back contractions over the spring and a hiring slowdown since employers were hit by increases in payroll taxes and the minimum wage in April. Economists expect the MPC to maintain guidance steering traders toward more gradual rate cuts.

Article content

A fifth quarter-point reduction today would take rates to the lowest since March 2023 and see the BOE pull ahead of the Federal Reserve, which has delivered 100 basis points of easing — all of it last year. On July 30, the US central bank held its benchmark rate in a range of 4.25%-4.5%.

Article content

Vote split

Article content

The BOE decision is likely to expose divisions on the nine-member committee panel once again.

Article content

Economists surveyed by Bloomberg predict a three-way split with the majority supporting a quarter-point reduction, two backing a bigger half-point cut and two others wanting no change in policy. That would be a repeat of the division three months ago when the MPC last lowered rates.

Article content

Article content

Chief economist Huw Pill and external rate-setter Catherine Mann are seen as the most likely to oppose a reduction, as they did in May, while Swati Dhingra and Alan Taylor may vote for a larger half-point cut.

Article content

Guidance

Article content

The MPC is expected to leave in place guidance steering markets toward more “gradual and careful” interest-rate cuts and a meeting-by-meeting approach.

Article content

However, traders will be watching closely for any hints that rate-setters are considering a slower pace as they edge toward the end of the cutting cycle. Currently markets expect two more reductions by the end of the year, including a move on Thursday, with rates eventually settling at around 3.5% next year.

Article content

“The risks are tilted in a hawkish direction – it’s possible the committee introduces language that suggests it is considering shifting away from its current pace of reducing rates once a quarter,” said Dan Hanson, chief UK economist at Bloomberg Economics. “The implication would be that a November cut is far from a done deal.”

Article content

Growth and inflation

Article content

The BOE may tweak its forecasts after hotter-than-expected inflation since its last projections in May, driven by sharp increases in energy and food prices.

.jpg) 3 hours ago

2

3 hours ago

2

English (US)

English (US)