Article content

(Bloomberg) — The Labour government’s payroll tax is costing the UK jobs, depressing workers’ earnings and pushing up food prices, Bank of England Governor Andrew Bailey said as he warned that the risks to inflation remain “two-sided.”

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

In a speech to the British Chambers of Commerce’s annual conference in London, Bailey said he was “beginning to hear a bit more evidence of adjustments through pay and employment” due to the £26 billion ($36 billion) increase in employers’ National Insurance Contributions that took effect in April.

Article content

Article content

Article content

“The latest data on pay settlements and pay expectations point to a significant decline in wage growth in the year ahead,” he added, as further evidence of the fallout from Labour’s first budget.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Bailey’s remarks expanded on his evidence before the House of Lords on Wednesday and set out the thinking behind his decision to vote with the majority on the Monetary Policy Committee to keep rates on hold at 4.25% last week.

Article content

Rates are on a “gradual downward path,” he stressed, and “evidence that slack is opening up has strengthened, especially in the labor market.” Despite the concerns about a softening jobs market, he remains alert to risks that inflation could prove persistent. The recent pick-up in inflation to 3.4%, largely driven rising energy bills, “introduces some further uncertainty into the near-term outlook,” he said.

Article content

Real-terms pay has risen for 21 months, helping to offset the squeeze on British families during the cost-of-living crisis. An end to the run would be a blow to households but would help the BOE press on with rate cuts.

Article content

Markets are pricing an 80% probability of a quarter point reduction to 4% next month, which would be a fifth reduction since August last year. Gilts were unchanged after Bailey’s speech.

Article content

Article content

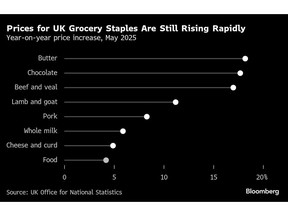

However, the decision is being complicated by Labour’s jobs tax and recycling levy, which also came into effect in April, alongside a hike in the minimum wage. Higher employment costs are cooling the labor market but rising food costs pose an upside inflation risk because they are “salient to consumers,” Bailey said. Food prices rose “materially” in May due to “labor costs” and “costs related to new packaging regulation,” he said.

Article content

Tax data suggested employment fell at the fastest pace in five years in May, with more than a quarter of a million jobs lost since the Labour government’s policies were announced last October.

Article content

Britain’s growth outlook is also poor. Uncertainty associated with trade “continues to have an impact on the UK economy,” Bailey added, and it “will grow at a more moderate pace over the coming quarters.”

Article content

“Businesses tell us that heightened uncertainty and a weak demand outlook are weighing on investment intentions. That could point to slower investment over coming months.”

Article content

Slow growth could limit the speed of rate cuts, though, if it reflects persistently weak productivity. Bailey suggested the BOE remains wary of cutting rates too fast in case weak supply triggers inflation.

Article content

“Slower potential supply growth reduces the rate at which economic activity can expand without generating inflationary pressures. Monetary policy has to respect this constraint,” he said.

Article content

Bailey said the BOE is also considering the rising pound. He said recent exchange rate movements have been driven by global disruptions, including investors reconsidering their dollar positions, rather than by differences in interest rates.

Article content

.jpg) 5 hours ago

1

5 hours ago

1

English (US)

English (US)