Article content

MONTREAL, Dec. 16, 2025 (GLOBE NEWSWIRE) — Aya Gold & Silver Inc. (TSX: AYA; OTCQX: AYASF) (“Aya” or the “Corporation”) is pleased to announce the filing of an updated NI 43-101 Technical Report for the Zgounder Deposit (“Zgounder”) (the “Technical Report”). The Technical Report includes updated Proven & Probable Mineral Reserves (“P&P Reserves”), and Mineral Resource Estimate (“MRE” or “Mineral Resource Estimate”), along with an accompanying updated Life of Mine (“LOM”) plan.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Article content

The Mineral Resource Estimate contained in the Technical Report was prepared by RSC Consulting Ltd. (“RSC”), while the remainder of the Technical Report, including the Mineral Reserve, was prepared by Aya. All financial figures in this press release are expressed in United States dollars unless otherwise noted.

Article content

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Key Highlights

Article content

- Updated LOM Plan

- Average Annual Silver Production: 6 million ounces (“Moz”) of silver (“Ag”) over the next 11 years, totaling ~66 Moz Ag over the LOM.

- Average LOM Operating Costs: Cash cost1 of $16.26/oz and $69.47 per tonne of ore (“t”) processed over the LOM.

- Sustaining Capital Expenditures: $71 million (“M”) over the LOM.

- Extended LOM to 2036: The updated mine plan is based on a capital-efficient open-pit strategy, with targeted underground zones, extending the mine life to 2036 and supported by net reserve growth.

- Net Reserve and Resource Growth

- P&P Reserves: 73 Moz Ag at 145 g/t (15.7 million tonnes (“Mt”)), a 4% increase in Ag ounces from the prior estimate, net of depletion, with reserves estimated using a silver price assumption of $26 per oz (“oz”).

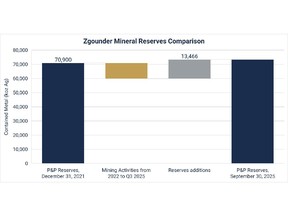

- Reserve Replacement: P&P Reserves include additions of 13 Moz, exceeding the 11 Moz mined since the prior estimate (December 31, 2021), resulting in a reserve-replacement ratio of 120%.

- Open-Pit Weighted Reserves: Reserves are now largely open-pit (78%), with underground reserves (22%) focused on deeper levels.

- Measured & Indicated Resources (“M&I Resources”)2: 100 Moz Ag at 165 g/t Ag (18.9 Mt), a 5% increase in total Ag ounces from the prior estimate, net of depletion, with resources estimated using a silver price assumption of $28/oz.

- Stronger Geological Model Supported by Extensive Drilling

- The updated interpretation incorporates ~275,000 metres (“m”) of drilling since 2021 (64% of all drilling on the property), and structural studies of the deposit, enhancing confidence in the resource model and the mine plan.

Article content

Article content

- Cash-cost is non-IFRS financial measures and have no standardized meaning under IFRS Accounting Standards (“IFRS”) and may not be comparable to similar measures used by other issuers. Refer to “Non-IFRS and Other Financial Measures” for more information, including a detailed description of this measure.

- Mineral Resources are inclusive of Mineral Reserves.

Article content

“The updated mine plan supports annual silver production of ~6 Moz over the next 11 years, with a disciplined, capital-efficient, open-pit focused strategy extending mine life to 2036,” said Benoit La Salle, President & CEO.

Article content

“The update reinforces the resource model and strength of the project. Extensive drilling, operational experience, and a deeper geological understanding have improved the reliability of the model and mine plan. We are pleased that exploration over the past several years has replenished reserves and contributed to net growth, providing a solid foundation to advance execution. The reserve estimate includes mining dilution in line with current operations.

Article content

“With the ramp-up phase complete and a favorable market landscape, we are well positioned to execute the plan and support Aya’s future growth. Zgounder remains open to the west, offering potential for long-term mine-life extension, and we will continue to evaluate opportunities for optimization and production increases as part of our commitment to long-term value creation.”

Advertisement 1

Advertisement 2

Article content

Mineral Resources

Article content

The June 30, 2025 Mineral Resource Estimate was prepared by RSC using Leapfrog Geo. Geological modelling was conducted using the interval selection and the vein system tools to create a geological model, consisting of a lithological model and a simplified structural model. Estimation domains using indicator radial basis function (RBF) interpolants were constrained at three different modelling grade cut-offs: 10.0 g/t Ag for low-grade mineralization (LG10), 60.0 g/t Ag for medium grade (MG60) and 150.0 g/t Ag for high grade (HG150). Grades were interpolated using ordinary kriging for the LG10 and MG60 domains and residual indicator kriging (RIK) for the HG150 domain.

Article content

The open pit Mineral Resource estimates are pit-constrained and reported above a 40 g/t Ag cut-off; the out-of-pit Mineral Resource estimates are reported above a 90 g/t Ag cut-off. The Mineral Resource estimates and metal content as of June 30, 2025, are detailed in Table 1.

Article content

Table 1: Mineral Resource Estimate for Zgounder as of June 30, 20251

Article content

| RPEEE | Cut-off Ag (g/t) | Classification | Tonnes (kt) | Ag (g/t) | Contained Metal (koz) |

| Pit Constrained | 40 | Measured | 13,820 | 144 | 64,140 |

| 40 | Indicated | 2,150 | 131 | 9,070 | |

| 40 | Inferred | 56 | 190 | 350 | |

| Out-of-Pit | 90 | Measured | 324 | 280 | 2,912 |

| 90 | Indicated | 2,640 | 284 | 24,100 | |

| 90 | Inferred | 360 | 360 | 4,200 | |

| Total | 40/90 | Measured | 14,150 | 147 | 67,050 |

| 40/90 | Indicated | 4,790 | 216 | 33,200 | |

| 40/90 | Inferred | 410 | 340 | 4,500 |

Article content

Article content

Notes:

Article content

- Mineral Resource Estimate for Zgounder as at June 30, 2025.

- The Mineral Resource is reported in compliance with National Instrument 43-101- Standards of Disclosure for Mineral Projects (“NI 43-101″) and CIM definition Standards (May 2014).

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues. There is no certainty that Mineral Resources will be converted to Mineral Reserves.

- Mineral Resources are reported inclusive of Mineral Reserves.

- A silver price of $28/oz with a process recovery of 90%, and a rock processing cost of $25/t inclusive of G&A were assumed.

- The constraining pit optimization parameters were 50º pit slopes with a 40 g/t Ag cut-off.

- The out-of-pit Mineral Resource grade blocks were quantified above a 90 g/t Ag cut-off, below the constraining pit shell and within the constraining mineralized wireframes. Out–of-pit Mineral Resources exhibit continuity and reasonable potential for extraction by the cut-and-fill underground mining method.

- Mining costs are estimated at $2.00/t of waste and $6.80/t of ore, with a mining dilution factor of 5%.

- The Mineral Resource is reported at an in-pit cut-off of 40 g/t Ag and an out of pit cut-off of 90 g/t Ag.

- A 3% royalty applies.

- Mineral Resources have been rounded to reflect their confidence.

- Totals may vary due to rounding.

Article content

Article content

Mineral Reserves

Article content

The Mineral Reserves are supported by LOM designs, underground development plans, production schedules, and cost estimates (including both operating and capital expenditures) prepared as part of Zgounder’s LOM update. All Inferred Mineral Resources within the mine designs have been classified as waste.

Article content

The Mineral Reserves tonnes and grades are stated at mill feed reference point, accounting for dilution and mining recovery, and reflect mine depletion as of September 30, 2025. The estimated Mineral Reserves and contained metal for Zgounder as of September 30, 2025, are detailed in Table 2 below.

Article content

Table 2: Mineral Reserve estimate for Zgounder, as of September 30, 20251

Article content

| Cut-off Ag (g/t) | Classification | Tonnes (kt) | Ag (g/t) | Contained Metal (koz) | |

| Stockpile | N/A | Proven | 160 | 134 | 690 |

| In-Pit Reserves | 40 | Proven | 11,750 | 137 | 51,800 |

| 40 | Probable | 1,220 | 133 | 5,200 | |

| UG Reserves | 90 | Proven | 180 | 207 | 1,200 |

| 90 | Probable | 2,390 | 189 | 14,500 | |

| Total | 40/90 | Proven | 12,090 | 138 | 53,690 |

| 40/90 | Probable | 3,610 | 170 | 19,700 | |

| Total P&P | 40/90 | P&P | 15,700 | 145 | 73,390 |

Article content

Notes:

Article content

- Mineral Reserves have been estimated by Aya Gold & Silver Technical Service team, under the supervision of Patrick Pérez, P.Eng, full-time employee of Aya Gold & Silver and Qualified Person as defined by NI 43-101. The estimate conforms to the CIM Definition Standards for Mineral Resources and Mineral Reserves.

- Mineral Reserves have been estimated using metal price assumption of $26/oz for silver.

- Open-pit Mineral Reserves are reported at a cut-off grade of 40 g/t Ag, and underground Mineral Reserves are reported at a cut-off grade of 90 g/t Ag.

- Cut-off calculations assume a processing and general & administration cost of $25.25/t, a metallurgical recovery of 90%, throughput of 1.4Mt per year, open-pit ore mining cost of $4.19/t, underground mining cost of $40/t, and an exchange rate of 9.5 MAD:US.

- Numbers may not add-up due to rounding.

Article content

Comparison with Previous Estimates

Article content

Table 3 provides a comparison between the previous MRE and P&P Reserves for the Zgounder Deposit, as reported in the Corporation’s previous technical report originally dated March 31, 2022, and amended on June 16, 2022, with an effective date of December 31, 2021, and this updated Technical Report, respectively.

Article content

Table 3: Zgounder Mineral Resources and Mineral Reserves1 – Comparison Summary

Article content

| Updated Technical Report | December 31, 2021 Technical Report | ||||||

| Tonnes (kt) | Grade (g/t Ag) | Contained Metal (koz Ag) | Tonnes (kt) | Grade (g/t Ag) | Contained Metal (koz Ag) | Change in Contained Metal (koz Ag) | |

| P&P Reserves (open pit) | 12,970 | 137 | 57,000 | 2,200 | 253 | 17,800 | 39,200 |

| P&P Reserves (underground) | 2,570 | 190 | 15,700 | 6,100 | 267 | 52,300 | (36,600) |

| P&P Reserves (stockpile / tailings) | 160 | 134 | 690 | 300 | 77 | 800 | (110) |

| Total P&P Reserves | 15,700 | 145 | 73,390 | 8,600 | 257 | 70,900 | 2,490 |

| M&I Resources (open pit) | 15,970 | 143 | 73,210 | 514 | 357 | 5,898 | 67,312 |

| M&I Resources (underground) | 2,964 | 283 | 27,012 | 8,979 | 309 | 89,337 | (62,325) |

| Total M&I Resources | 18,934 | 165 | 100,222 | 9,493 | 312 | 95,235 | 4,987 |

| Inferred Resources | 410 | 340 | 4,500 | 542 | 367 | 6,395 | (1,895) |

Article content

Article content

Notes:

Article content

- M&I Resources are inclusive of Mineral Reserves.

- Updated Technical Report Mineral Resources are reported assuming a silver price of $28/oz, and Mineral Reserves are reported assuming a silver price of $26/oz, and accounting for mine depletion until September 30th, 2025.

- December 31, 2021 Mineral Resources are reported assuming a silver price of $22.5/oz, and Mineral Reserves are reported assuming a silver price of $20/oz.

Article content

Compared with the previous estimate, the updated P&P Reserves show a net increase of approximately 2.5 Moz Ag, and the M&I Resources (inclusive of reserves) show an overall increase of 5.0 Moz, after accounting for all material mined from 2022 through Q3-2025. Open-pit Mineral Reserves have increased, while underground Reserves have decreased, reflecting Aya’s strategy to expand the open-pit operation while focusing underground mining on deeper levels. Reported grades are lower, primarily due to the integration of extensive new drilling, improved geological interpretation, and updated estimation methods better suited to the deposit’s complex ore distribution. The updated P&P Reserves also incorporate dilution assumptions informed by current mining practices and benefits from enhanced geological and structural interpretations resulting in a more accurate representation of the deposit’s geometry and grade profile.

Article content

Article content

Approximately 275,000m of drilling have been completed since the previous estimate, representing 64% of all drilling conducted on the property to date. With this extensive drilling, enhanced understanding of the resource, and an independent third-party review, the updated MRE provides a clearer and more representative view of the deposit.

Article content

Article content

Article content

Article content

Figure 1: Mineral Reserves estimate comparison between 2021 and Q3-2025

Article content

Life of Mine Plan

Article content

The LOM plan for Zgounder incorporates both open-pit and underground mining, alongside the reclamation of surface stockpiles, with all the ore processed at the Zgounder mill. Based on the 2025 Mineral Reserves, the mine life is projected to run until 2036, with average production of approximately 6.2 Moz from 2026 through 2036. Key aspects of the LOM plan include:

Article content

- Mining Methods: A mix of cut-and-fill and longhole stope mining is planned though the LOM, with a gradual shift towards greater reliance on longhole mining and reduced cut-and-fill.

- Underground Sequencing: Cut-and-fill mining will continue through 2031, while longhole mining will start in 2026 and run through 2032.

- Open-Pit Mining: Open-pit mining will continue until 2036, with mining rates averaging at 45 thousand tonnes per day (“ktpd”) of material (ore and waste) until 2030, moderating to 22 ktpd until 2033, and 12-14 ktpd for the remainder of the LOM.

- Processing: The processing plant is expected to operate at a rate of 3,650 ktpd through 2026 and then at 3,850 ktpd through the end of the LOM.

- Development: A total of 8,340m of lateral development and 2,402m of vertical development are planned by 2029.

- Metallurgy: Silver recovery is estimated at 91.5%

- LOM Operating Costs: Average operating costs of $69.47/t processed for a cash cost of $16.26/oz.

- Sustaining Capital Expenditures: $71M over the LOM.

Article content

Table 4 provides a summary of the production profile, operating costs and capital costs from 2026 through the end of the LOM.

Article content

Table 4: Zgounder LOM Plan Summary and Key Metrics

Article content

| Production | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 | 2036 | Total | |

| Open pit waste | Mt | 14.4 | 14.5 | 15.5 | 13.7 | 15.5 | 5.7 | 7.7 | 3.2 | 3.3 | 3.9 | 1.6 | 99.1 |

| Open pit ore | Mt | 0.9 | 0.9 | 1.3 | 1.2 | 1.5 | 1.2 | 1.4 | 1.2 | 1.2 | 1.3 | 0.6 | 12.7 |

| Underground ore | Mt | 0.5 | 0.4 | 0.3 | 0.3 | 0.4 | 0.4 | 0.2 | – | – | – | – | 2.5 |

| Processed ore | Mt | 1.3 | 1.4 | 1.4 | 1.4 | 1.4 | 1.4 | 1.4 | 1.4 | 1.4 | 1.4 | 1.4 | 15.4 |

| Silver produced | Moz | 5.8 | 6.2 | 6.3 | 6.4 | 6.3 | 6.4 | 6.2 | 6.1 | 6.0 | 5.9 | 4.0 | 65.6 |

| Operating costs | |||||||||||||

| Open pit production | $M | 39.7 | 39.8 | 44.0 | 39.2 | 45.1 | 19.4 | 25.5 | 13.5 | 13.7 | 15.5 | 6.6 | 302.0 |

| Underground prod. | $M | 29.8 | 27.2 | 20.3 | 21.3 | 25.0 | 24.6 | 11.6 | – | – | – | – | 159.8 |

| Processing | $M | 28.3 | 29.7 | 29.7 | 29.7 | 29.7 | 29.7 | 29.7 | 29,7 | 29.7 | 29.7 | 29.4 | 325.1 |

| G/A* | $M | 25.3 | 25.8 | 26.1 | 26.1 | 26.1 | 26.1 | 25.9 | 25.7 | 25.5 | 25.4 | 22.6 | 280.5 |

| Total | $M | 123.2 | 122.5 | 120.1 | 116.3 | 125.9 | 99.8 | 92.8 | 68.8 | 68.9 | 70.6 | 58.7 | 1,067.5 |

| Cash cost1 | $/oz | 21.21 | 19.78 | 18.94 | 18.26 | 19.91 | 15.70 | 14.96 | 11.23 | 11.44 | 11.94 | 14.70 | 16.26 |

| *G/A includes site support, external costs, Casablanca and Montreal operation support, mining tax and royalties. Royalties are 3% of revenues, and mining tax is 30MAD per tonne of ore mined. MAD/USD conversion rate used of 9.37. Silver price of $28 was used for royalty calculation. | |||||||||||||

| Capital cost | |||||||||||||

| Lat. Declined Dev. | $M | 9.4 | 4.4 | 2.9 | 0.9 | – | – | – | – | – | – | – | 17.6 |

| Vertical Dev. | $M | 1.8 | 0.5 | 0.2 | 0.7 | – | – | – | – | – | – | – | 3.2 |

| Mining Equipment | $M | 2.2 | 1.2 | 0.9 | 1.3 | 0.7 | 0.1 | 0.1 | 0.1 | 0.1 | – | – | 6.6 |

| Mining Services | $M | 1.3 | 1.2 | 1.1 | 0.3 | – | – | – | 0.2 | – | – | – | 4.1 |

| Tailing Facility | $M | 7.4 | – | – | 7.4 | – | – | 7.0 | – | 3.0 | – | – | 24.8 |

| Closure Costs | $M | – | – | – | – | – | – | – | – | – | 2.0 | 2.0 | 4.1 |

| Process Plant | $M | 6.0 | 5.0 | – | – | – | – | – | – | – | – | – | 11.0 |

| Total | $M | 28.1 | 12.3 | 5.1 | 10.6 | 0.7 | 0.1 | 7.1 | 0.2 | 3.1 | 2.0 | 2.0 | 71.4 |

Article content

Article content

- Cash-cost is non-IFRS financial measures and have no standardized meaning under IFRS Accounting Standards (“IFRS”) and may not be comparable to similar measures used by other issuers. Refer to “Non-IFRS and Other Financial Measures” for more information, including a detailed description of each measure.

Article content

Qualified Persons

Article content

The scientific and technical information contained in this press release has been reviewed for accuracy and compliance with NI 43-101, and approved by Olivier Bertoli M.Eng, General Manager Resources & Reserves for RSC Consulting Ltd, Patrick Perez, P.Eng, Director Technical Services, Raphael Beaudoin, P. Eng, Vice-President, Operations, and by David Lalonde, B. Sc, P.Geo, Vice-President Exploration, each a Qualified Person as defined in NI 43-101.

Article content

The independent Qualified Persons for the Updated Technical Report, as defined by NI 43-101, are:

Article content

- Olivier Bertoli, M.Eng., Principal Geostatistician for RSC Consulting Ltd

- Abraham Whaanga, B.Sc., Sr Resource Geologist for RSC Consulting Ltd

- Honza Catchpole, PhD, P.Geo., Sr Exploration Geologist for RSC Consulting Ltd

Article content

Article content

Technical Report

Article content

The complete NI 43-101 Technical Report supporting the updated Mineral Resource and Mineral Reserve estimates has been filed today and is available on Aya’s website and on SEDAR+.

Article content

About Aya Gold & Silver Inc.

Article content

Aya Gold & Silver Inc. is a rapidly growing, Canada-based silver producer with operations in the Kingdom of Morocco.

Article content

The only TSX-listed pure silver mining company, Aya operates the high-grade Zgounder Silver Mine and is exploring its properties along the prospective Anti-Atlas Fault, several of which have hosted past-producing mines and historical resources.

Article content

Aya’s management team has been focused on maximizing shareholder value by anchoring sustainability at the heart of its operations, governance, and financial growth plans.

Article content

For additional information, please visit Aya’s website at www.ayagoldsilver.com.

Article content

Or contact

Article content

Article content

Forward-Looking Statements

Article content

This press release contains “forward-looking statements” or “forward looking information” within the meaning of applicable securities laws and other statements that are not historical facts. Forward-looking statements are included to provide information about management’s current expectations, estimates and projections regarding Aya’s future growth and business prospects (including the timing and development of deposits and the success of exploration activities) and other opportunities as of the date of this press release.

Article content

All statements, other than statements of historical fact included in this press release, regarding the Corporation’s strategy, future operations, technical assessments, prospects, plans and objectives of management are forward-looking statements that involve risks and uncertainties. Wherever possible, words such as “aim”, “anticipate”, “assume”, “believe”, “estimate”, “expect”, “guidance”, “goal”, “intend”, “objective”, “plan”, “potential”, “strategy”, “target”, and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might”, “will”, or are “likely” to be taken, occur or be achieved, have been used to identify such forward-looking information. Forward-looking statements in this press release include, but are not limited to, statements with respect to: certain results and interpretations derived from the technical report discussed in this press release including without limitation, Zgounder project economics, financial and operational parameters such as expected throughput, production, grade, sustaining capital expenditures and operating costs, allocation of production between open-pit and underground, production sequencing, mining rate, mine development activities, silver recovery, cash costs, mining costs, life of mine, updated mine plan, mine design, mining methods and mine sequencing, and processing rates of the processing plant; the future price of gold and silver; development opportunities; the estimation of mineral resources and mineral reserve and the realization of such estimates; and requirements for additional capital.

Article content

Article content

Forward-looking information is based upon certain assumptions and other important factors that, if untrue, could cause the actual results, performance or achievements of the Corporation to be materially different from future results, performance or achievements expressed or implied by such information or statements. There can be no assurance that such information or statements will prove to be accurate. Key assumptions upon which the Corporation’s forward-looking information is based include without limitation, assumptions regarding development and exploration activities; the timing, extent, duration and economic viability of such operations, including any mineral resources or mineral reserves identified thereby; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the Corporation’s ability to meet or achieve estimates, projections and forecasts; the availability and cost of inputs; the price and market for outputs; foreign exchange rates; taxation levels; the timely receipt of necessary approvals or permits; the ability to meet current and future obligations; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions; and other assumptions and factors generally associated with the mining industry.

Article content

Article content

Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used. Forward-looking statements are also subject to risks and uncertainties facing the Corporation’s business, any of which could have a material adverse effect on the Corporation’s business, financial condition, results of operations and growth prospects. Some of the risks the Corporation faces and the uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements include, among others: the inherent risks involved in exploration and development of mineral properties, including (1) there being no significant disruptions affecting the operations of the Corporation whether due to artisanal miners, access to water, extreme weather events and other or related natural disasters, labour disruptions, supply disruptions, power disruptions, damage to equipment or otherwise; (2) permitting, development, operations and production from the Zgounder project being consistent with the Corporation’s expectations; (3) political and legal developments in the Kingdom of Morocco being consistent with its current expectations; (4) the exchange rate between the U.S. dollar and the Moroccan Dirham being approximately consistent with current levels; (5) certain price assumptions for gold and silver; (6) prices for diesel, process reagents, fuel oil, electricity and other key supplies being approximately consistent with current levels; (7) production and cost of sales forecasts meeting expectations; (8) the accuracy of the current mineral resources and mineral reserves estimates of the Corporation; (9) labour and materials costs increasing on a basis consistent with the Corporation’s current expectations; and (10) asset impairment (or reversal) potential, being consistent with the Corporation’s current expectations.

Article content

In addition, readers are directed to carefully review the detailed risk discussion in the Corporation’s Annual Information Form and Management’s Discussion & Analysis for the year ended December 31, 2024, filed on SEDAR+, which discussions are incorporated by reference in this news release, for a fuller understanding of the risks and uncertainties that affect the Corporation’s business and operations.

Article content

Although the Corporation believes its expectations are based upon reasonable assumptions and has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. As such, these risks are not exhaustive; however, they should be considered carefully. If any of these risks or uncertainties materialize, actual results may vary materially from those anticipated in the forward-looking statements found herein. Due to the risks, uncertainties, and assumptions inherent in forward-looking statements, readers should not place undue reliance on forward-looking statements.

Article content

Article content

Forward-looking statements contained herein are presented for the purpose of assisting investors in understanding the Corporation’s business plans, financial performance and condition and may not be appropriate for other purposes.

Article content

The forward-looking statements contained herein are made only as of the date hereof. The Corporation disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by applicable law. The Corporation qualifies all of its forward-looking statements by these cautionary statements.

Article content

Notes to Investors Regarding the Use of Mineral Resources and Mineral Reserves

Article content

The mineral resources estimate for Zgounder is effective as of June 30, 2025, as disclosed in a technical report titled “Technical Report – Updated Mineral Resource and Mineral Reserves Estimate of the Zgounder Silver Mine Operation, Kingdom of Morocco” dated as of December 16, 2025, (the “Technical Report”), and filed on SEDAR+ as of such date. The mineral reserves estimate for Zgounder is effective as of September 30, 2025, as disclosed in the Technical Report. The key assumptions, parameters and methods used to estimate the mineral resources and mineral reserves for Zgounder and the identification of known legal, political, environmental or other risks that could materially affect the potential development of the mineral resources and mineral reserves are described in such Technical Report.

Article content

Article content

Mineral resources are not mineral reserves and do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. There is no certainty that mineral resources will be converted to mineral reserves.

Article content

Non-IFRS and Other Financial Measures

Article content

This press release includes certain performance measures commonly used in the mining industry that are not defined under IFRS. These measures do not have any standardized meaning under IFRS and may not be comparable to similar measures used by other companies. They are provided to assist readers in evaluating the Corporation’s performance and should not be considered in isolation or as a substitute for IFRS measures.

Article content

The non-IFRS financial measures and non-IFRS financial ratios used in this press release and common to the mining industry are defined below:

Article content

Cash Costs

Article content

Cash costs is a non-IFRS financial measure which includes mine-site operating costs such as mining, processing, and direct site G&A, product shipping, royalties and mining taxes. Cash costs exclude sustaining capital, corporate G&A, exploration, reclamation, and financing costs. Cash costs presented on a per-ounce-of-silver produced basis is a non-IFRS financial ratio which is calculated as cash costs divided by anticipated production expressed in in ounces of silver. This measure captures the important components of the Corporation’s anticipated production and related costs and are used to indicate anticipated cost performance of the Corporation’s operations.

Article content

Article content

Article content

Article content

Article content

Article content

Article content

.jpg) 10 hours ago

2

10 hours ago

2

English (US)

English (US)