Article content

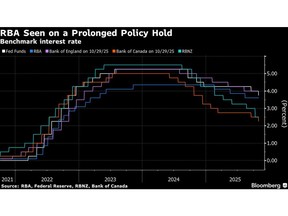

(Bloomberg) — Expectations for Australia’s central bank meeting this week are straightforward: policymakers will leave interest rates unchanged, and Governor Michele Bullock will steer clear of any guidance as the outlook grows murkier.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Economists unanimously expect the Reserve Bank will keep rates at 3.6% at its Nov. 3-4 meeting, a Bloomberg survey showed, after consumer prices surged beyond expectations. Overnight-indexed swaps also indicate a pause is all-but guaranteed, with the next cut only priced in for May 2026.

Article content

Article content

Article content

“With the latest inflation number it’s probably going to be difficult for the RBA to cut rates again in the short term,” said Sam Konrad, a Singapore-based portfolio manager for Jupiter Fund Management. “When you look at the Australian economy, there are mixed data points so I don’t think there’s an urgent need to cut rates further from here. What’s most important is that they make sure inflation is under control.”

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

The rate decision and statement will be published at 2:30 p.m. in Sydney on Tuesday — with investors keeping a close eye on the board vote for any defections — and the RBA will simultaneously release its quarterly update of economic forecasts. Bullock holds a press conference an hour later.

Article content

Australia’s anticipated pause will come a few days after the Federal Reserve cut its key rate for a second consecutive meeting, and despite a hawkish bent, markets still see a decent chance the US central bank will ease again in December as job gains slow.

Article content

Forecasts for RBA policy shifted sharply last week after core inflation climbed 1% in the third quarter from an upwardly revised 0.7% in the prior three months. On an annual basis, core prices advanced to the top of the RBA’s 2-3% target.

Article content

Article content

The acceleration was broad-based and validated the central bank’s worries that inflation, in particular the services component, is proving sticky. Domestic demand is strengthening in response to government income tax cuts and energy rebates earlier this year, while the RBA’s prior rate cuts are also gradually filtering through the economy.

Article content

As a result, the Australian dollar was the best performing major currency last week. It has become a “hot favorite” among investors helped by a hawkish RBA, better risk appetite and easing US-China trade tensions, according to Alex Loo and Prashant Newnaha at TD Securities Ltd.

Article content

Recent data showed credit growth and house prices have picked up, suggesting financial conditions aren’t overly restrictive. Bullock has described current policy as still a little bit tight.

Article content

“The underlying momentum of inflation is far stronger than the RBA was expecting,” said George Tharenou at UBS AG. “The key question now is whether to delay the next cut, or to call the trough” in the rate cycle.

Article content

UBS expects the RBA will stand pat until at least May 2026.

.jpg) 12 hours ago

2

12 hours ago

2

English (US)

English (US)