Article content

(Bloomberg) — Stocks in Asia are set for a cautious open after mixed US inflation data spurred traders to trim Federal Reserve rate-cut bets. The dollar rose, Treasuries declined and the yen touched its weakest since April.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

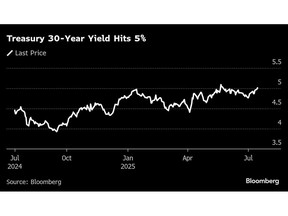

Equity futures for Japan and Australia fell as the S&P 500 closed 0.4% lower. Hong Kong stock contracts gained as US tech shares jumped on news Nvidia Corp. and Advanced Micro Devices Inc. will resume some chip sales to China, while an index of US-listed Chinese shares climbed to its highest since April. While short-dated Treasuries led losses, longer maturities also slid — with 30-year yields topping 5%. The dollar rose 0.4%.

Article content

Article content

Article content

Underlying US inflation rose by less than expected for a fifth month in June even as the details signaled companies are beginning to more meaningfully pass some tariff-related costs to consumers. Traders priced in somewhat lower odds that the Fed will cut rates more than once this year, and the probability of a move in September is now seen as only slightly higher than 50%.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“The big question for the inflation picture is tariffs. It’s taking some time for tariffs to show up in the data, but it’s highly likely that a tariff-driven inflation reckoning is coming,” said Skyler Weinand at Regan Capital. “The Fed will want to watch the next several inflation and jobs reports before it makes any moves on rates.”

Article content

Traders will be monitoring for additional information on tariff moves, after President Donald Trump said he reached a deal with Indonesia that will see goods from the country face a 19% rate, while US exports will not be taxed. An accord would be the fourth trade framework Trump has announced since pausing his country-specific tariffs, after pacts with Vietnam, the UK and China that have thus far fallen short of full-fledged trade agreements.

Article content

Article content

Meanwhile, Treasury Secretary Scott Bessent suggested that Fed Chair Jerome Powell should step down from the board when his term is up in May 2026. Asked whether Trump has asked Bessent himself to serve as Fed chair, the Treasury chief said, “I am part of the decision-making process.” He noted that “it’s President Trump’s decision, and it will move at his speed.”

Article content

The consumer price index, excluding the often volatile food and energy categories, increased 0.2% from May. While a decline in car prices helped keep a lid on the figure, goods categories exposed to Trump’s levies including toys and appliances rose at the fastest paces in years.

Article content

To Ellen Zentner at Morgan Stanley Wealth Management, inflation has begun to show the first signs of tariff pass-through. While services inflation continues to moderate, the acceleration in tariff-exposed goods is likely the first of greater price pressures to come, she said.

Article content

“While any tariff-induced boost to inflation is likely to be short-lived, with higher tariffs being announced, it would be wise for the Fed to remain on the sidelines for a few more months at least,” said Seema Shah at Principal Asset Management.

.jpg) 15 hours ago

1

15 hours ago

1

English (US)

English (US)