Article content

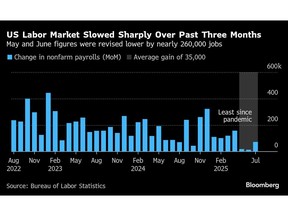

(Bloomberg) — A selloff in Asian stocks extended to a seventh day after weak US jobs data triggered a pullback in equities and fueled bets on an interest-rate cut by the Federal Reserve.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

The MSCI Asia Pacific Index fell 0.3% as shares in Japan slumped more than 2%. South Korean shares fluctuated amid speculation about revising a capital gains tax. Bonds pared back gains across the curve Friday. Oil retreated as OPEC+ wrapped up a run of major output hikes. The dollar edged lower for a second day while gold was down 0.3%.

Article content

Article content

Article content

The moves suggest Friday’s sharp retreat on Wall Street — sparked by rising US unemployment and slower job creation — is still rippling through global markets. The weak data is fueling investor concern after US stocks rallied for three straight months on speculation the US economy would withstand President Donald Trump’s tariff storm.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

“All of a sudden, questions are being raised about the continued expansion of the US economy,” wrote Kyle Rodda, a senior market analyst at Capital.com in Melbourne. Despite the markets pricing in chances of a September rate cut, “it was risk-off in the markets, showing it was a veritable case of bad news being bad news,” he said.

Article content

The S&P 500 ended Friday 1.6% lower and the tech-heavy Nasdaq 100 dropped 2%, the biggest one-day declines in months for the two benchmarks.

Article content

The US 10-year yield dropped 16 basis points Friday while policy-sensitive two-year yields fell 28 basis points. The sharp declines reflected heightened anticipation the Fed will cut interest rates in its September meeting after holding borrowing costs steady in its last meeting.

Article content

Article content

Article content

Following the jobs data, some market-watchers are even anticipating the Fed may cut rates by 50 basis points, twice the regular amount.

Article content

“September is a lock for a rate cut — and it might even be a 50-basis point move to make up the lost time,” said Jamie Cox at Harris Financial Group.

Article content

In oil, OPEC+ agreed to another major output increase, stoking concerns about global oversupply just as the US-led trade war may be exacting a toll on economic growth and energy consumption.

Article content

Brent edged lower toward $69 a barrel, while West Texas Intermediate was near $67, after OPEC+ endorsed an additional 547,000 barrels-a-day of output from September.

Article content

Separately, Trump said he will announce a new Fed governor and a new jobs data statistician in the coming days, two appointments that could shape his economic agenda.

Article content

The Fed announced Friday that Adriana Kugler will step down from her position as a governor, giving Trump an opportunity to install a policymaker who aligns with his demands for lower interest rates.

Article content

Also on Friday, Trump fired chief labor statistician Erika McEntarfer hours after labor market data showed weak jobs growth based in part on steep downward revisions for May and June.

.jpg) 1 hour ago

1

1 hour ago

1

English (US)

English (US)